Weekly Recap - 06.11.2023

🧠Quote of the week:

The anniversary of Guy Fawkes’ Gunpowder Plot is a perfect time to remember Bitcoin as truth and to move another step closer to obsoleting the parasitic nature of the current system.

Vi veri veniversum vivus vici -> “By the power of truth, I, while living, have conquered the universe.”

“Remember, Remember! The Fifth of November, The Gunpowder Treason and Plot; I Know Of No Reason, Why The Gunpowder Treason, Should Ever Be Forgot!”

Bitcoin is our own truth:

“Remember, remember, it is the 5th of November.

The Bitcoin Revolution and Plot,

I know of no reason why the Bitcoin Revolution

Should ever be forgotten.”

🧡Bitcoin news:

Before we start with the Weekly Recap some extra info for the Dutch followers.

Early general elections are scheduled to be held in the Netherlands on 22 November 2023 to elect the members of the House of Representatives.

Do you want to know what the current positions of political parties are regarding Bitcoin, cryptocurrencies, and digital central bank digital currency (CBDC)?

Click here

➡️ The World Bank published a report on Gas flaring, that mentions Bitcoin about 40 times. They’re acknowledging the powerful incentive structure that Bitcoin offers to tackle Climate Change.

So it’s not only the pro-Bitcoiners, for example ‘”With real-world data, we (@ARKInvest) demonstrate that Bitcoin mining could encourage investment in solar systems (solar grids + batteries), enabling renewables to generate a higher percentage of grid power” or “Bitcoin mining reduces the CO2-equivalent emissions by about 63% when compared to traditional methods of flaring methane, explains @GigaEnergy_”

➡️ Great move by Vanguard, NOT!

Chairman and CEO of Vanguard Group Tim Buckley says the firm won’t join the Bitcoin ETF race, as Vanguard claims to be focused on asset classes with an intrinsic value and capable of generating cash flows, like equities and bonds.

Why move ahead into the future when the past was so profitable for you?

Talking about living in the past…“We will stay focused on the horse and buggy. The auto-carriage is a fad.” Same vibe!

➡️Berkshire Hathaway’s vice chairman Charlie Munger: “Bitcoin is like throwing a stink ball into a recipe that’s been around for a long time, that’s worked very well for a lot of people”.

I will quote James Lavish:

“Ah yes. ‘The recipe’. The richest 1% seized 2/3s of all new wealth ($42 trillion) created since 2020, about twice the rest of the bottom 99%. And billionaire fortunes are increasing by $2.7 billion per day, while over 1.7 billion workers now live in countries where inflation is outpacing wages. (h/t@Oxfam) It appears that 1% of the population is a lot of people to Charlie (and others just like him).”

➡️PayPal just got approved to offer Bitcoin and crypto services in the UK.

➡️On the first of November, we’ve officially mined 93% of the 21m Bitcoin. The majority of it is in long-term storage or lost forever. Over the next 117 years, billions of people will compete over the remaining 7%.

➡️The correlation between the S&P500 and Bitcoin has collapsed to less than 0.

Is Bitcoin now being recognized as a global “flight to safety” in these uncertain times when compared to “risk-on” assets like stocks?

I will quote this excellent tweet by Henry Schaffer:

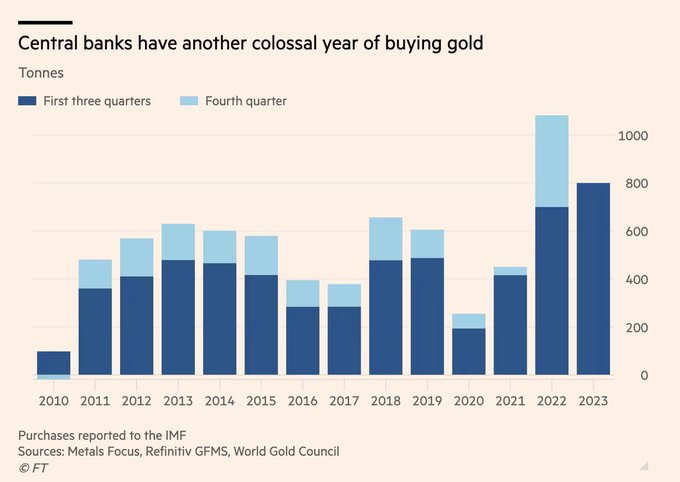

“Gold will run hot early but will eventually peter out as it becomes clear that Bitcoin is a harder asset and superior sound money. Also, as boomers age and digitally native Millenials/Gen-Z enter prime earning years, demand will shift from gold to Bitcoin.”

All boomer retirement accounts will own/want to own Bitcoin. Remember we will transit from inside money (treasuries) to outside money (hard money) aka. Bitcoin / Gold.

➡️ Federal Reserve threatens to sue Bitcoin Magazine in an attempt to silence criticism (their satirical “FEDNOW” merchandise, which incorporates a panopticon eye into the logo design) of its FedNow service.

For more information: https://www.zerohedge.com/crypto/fed-threatening-sue-bitcoin-magazine

TLDR: Bitcoin Magazine tells them to GFY

➡️ Spot exchange volumes surpassed $24B, reaching an 8-month high amid expectations of an imminent Bitcoin ETF approval

➡️ Argentina’s two remaining Presidential candidates: Sergio Massa – Wants to mine Bitcoin with excess natural gas. Javier Milei – Says Bitcoin can eliminate the central bank. Argentina’s economy is 20x bigger than El Salvador’s.

At the moment (3rd of November), Argentinian Libertarian Javier Milei has a 4-point lead over Economic Minister, Sergio Massa, for the upcoming presidential runoff.

➡️Financial giant Block sold $2.42 billion worth of Bitcoin to customers through Cash App in Q3. That’s 40% of Block’s total revenue.

➡️ Jury finds Sam Bankman-Fried guilty of all seven criminal counts against him. The former FTX CEO faces a maximum sentence of 115 years in prison. Fraud in the collapse of FTX was “worse than Enron” according to advisors. $10 billion in customer funds were missing. US Attorney says Sam Bankman-Fried perpetrated one of the biggest financial crimes in US history.

I quote Erik Voorhees: “Let’s remember that he operated “the safe and regulated” exchange, and not a single regulator caught him. It was, instead, the market, which is not only a great fountain of innovation but also the best arbiter of discipline and justice.”

Anyway, the Fed is a greater scam than FTX. More on that below in the segment Traditional Finance & Macro.

➡️ One of Austria’s oldest football clubs, FC Admira Wacker, puts the Bitcoin logo on the jersey and will integrate Lightning payments. One of Austria’s oldest and most traditional clubs, FC Admira Wacker, is becoming the first Bitcoin football club in the German-speaking part of Europe. LN integration, merchandising, educational content, and many more fun projects on Bitcoin to come

➡️ Marathon Digital to partner with Nodal Power for the development of a 280-kilowatt (kW) Bitcoin mining project in Utah, powered by landfill-generated methane.

Their official statement: “Today, we’re announcing the energization of our first Bitcoin mining pilot project powered by renewable, off-grid energy from a landfill. The project is currently fully energized and operational.”

Learn more: here

TLDR: A brilliant way to cut emissions and go green. Can somebody please call Greenpeace USA, Alex de Vries, or Paul Tang (EU Member of the European Parliament)

➡️Percentage of Bitcoin supply that has not been moved for at least 1- year is nearing a new all-time high

➡️ New record Bitcoin hashrate! 450,000,000,000,000,000,000x per second

Traditional Finance & Macro/Geopolitics:

👉🏽Stan Druckenmiller on CNBC: “My generation… we’ve given nothing. We’ve given nothing! And now we want to screw our grandchildren… We’ve got to stop guys, we’re DRUNK.”

🏦Banks:

👉🏽Not really news, but just a reminder. 110 years ago, the Federal Reserve was founded. Since then, the US dollar has lost over 97% of its value.

👉🏽On November 3rd, the Federal Reserve said: “ACH Error Impacting Customers “

“Their ACH network had a problem that reveals a lack of data verification and validation in their proprietary fiat software. Instead of taking ownership of the protocol problem and fixing the root cause, the Fed is throwing EPN under the bus.” – Pierre Rochard.

The Clearing House’s ACH operations service is called EPN, which handles essentially half the U.S. commercial ACH volume.

and on the same day: “Switzerland to restrict bank withdrawals and impose ‘exit fees’ on customers who take their money out under new rules being considered” – Reuters

AND

UK bank NatWest is telling customers to reduce their carbon footprint, eat vegetarian, and stop drinking dairy milk after scanning their transaction data – Telegraph

Bitcoin literally fixes this! Bitcoin is the exit!🧡

👉🏽Summary of Fed decision:

“1. Fed leaves rates unchanged for a second straight time

2. The Fed will assess the extent of “additional tightening”

3. Tighter credit conditions continue to weigh on the economy

4. The Fed will “continue to assess additional information”

5. The inflation target remains at 2%

The Fed is bracing for a LONG PAUSE.”

It looks like rate hikes are done. But higher rates are still necessary to get a grip on inflation and the economy.

👉🏽Dutch Inflation to the LOWEST level on record! EU Harmonized CPI -1.0%. Hello, deflation!

👉🏽”Eurozone inflation sinks to 2-year low as the Eurozone economy shrinks: CPI slowed to 2.9% in Oct, down from 4.3% and better than expected 3.1%. But Core CPI – that excl food and energy is retreating less rapidly. It moderated to 4.2% in Oct from 4.5% the previous month.” – Holger Zschaepitz

👉🏽”ISM Manufacturing comes in at 46.7 vs an estimate of 49 The fall was led by a collapse in new orders (from 49.2 to 45.5) and employment (from 51.2 to 46.8) This is not a great set of data by any stretch of the imagination.”

Here in Europe, we are already experiencing a manufacturing depression, especially in Germany.

This is the Fed’s worst nightmare: Stagflation.

👉🏽”The more Fed Chair Jay Powell speaks, the more the market hears that the US central bank is done with rate hikes in this economic cycle. US 2-year yields plunge.” – Lisa Abramowitz

👉🏽 “Dollar drops, Bond yields slide following VERY disappointing US jobs data which fuel bets Fed is done. US econ added 150k jobs in Oct, less than 180k expected. Revisions were negative. Household Survey showed a huge 348k loss in jobs during Oct, unemployment rate ticked up to 3.9% vs 3.8% exp.” Holger Zschaepitz

👉🏽 FED Barkin: “I am hearing more evidence of middle-income consumers cutting spending, high-end consumers are not cutting back”

Ergo: we are screwing the middle class

👉🏽The fiat system is fueled by debt. “The US ended last week with $33.7 trillion of federal debt and $211.2 trillion of unfunded liabilities, bringing the total amount owed to ~$245 trillion. That’s approximately 55X tax revenues, or the equivalent of someone with a $100K salary and $5.5 million of debt.” – James Lavish

The bottom of the unemployment rate was 3.4%. Today unemployment printed at 3.9% in the US. Another 2 months of 3.9% cement the recession according to the Sahm rule.

What is the Sahm Rule? The rule, hatched by former Federal Reserve economist and now Bloomberg columnist Claudia Sahm, posits the start of a recession when the three-month moving average of the unemployment rate rises by a half-percentage point or more relative to its low during the previous 12 months.

The preserve logic of the market (Wall Street):

Unemployment up = Market up

👉🏽Biden’s Dept of Fake Data doing its thing: August jobs revised down by 62,000, from +227K to +165K September was revised down by 39,000, from +336K to +297K 8 of the past 9 months have been revised lower.

The much more accurate and less manipulated Household survey shows employment collapsed by 348K, the biggest drop since the Covid shutdown. It’s almost certain the US is already in recession.

If you have made it this far I would like to give a little gift, a keynote talk by @gladstein of the Human Rights Foundation:

“The Currency Caste System”

TLDR: “150+ fiat currencies allow for massive exploitation via endless wage devaluation. Billions get squeezed Bitcoin threatens to obsolete this system with one neutral, open, global currency”

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The Relai app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy.

For new users, the app can be downloaded from all Play Stores. The iOS version is only available in Swiss, Austrian, German, and Italian App Stores. If you set up a Bitcoin Savings Plan (weekly/monthly) you can use my code CRYPTOFRIDAY and your fees will be reduced by 0.5%!

Check out my tutorial post (Instagram) & video (Youtube) for more info. ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple. ⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it!🧡

Or support my work with Bitcoin:

Disclaimer: This article should not be taken as, and is not intended to provide any investment advice. It is for educational and entertainment purposes only. As of the time of posting, the writer(s) may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency, as all investments contain risk. All opinions expressed in these articles are my own and are in no way a reflection of the views of the used sources.

Latest articles:

The Latest Bitcoin & Macro news: Weekly Recap 30.07.2024

🧠Quote(s) of the week: 'In a world of exponentially growing trust problems, it is prudent to own Bitcoin, the only asset that requires zero trust.' -James Lavish 'Bitcoin is a tool for: Financial inclusion Banking the unbanked Eliminating financial discrimination...

The Latest Bitcoin & Macro news: Weekly Recap 22.07.2024

🧠Quote(s) of the week: 'The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.' -Nassim Taleb 🧡Bitcoin news🧡 Now before I start with the Weekly Recap I want to...

The Latest Bitcoin & Macro news: Weekly Recap 15.07.2024

🧠Quote(s) of the week:'If you want to keep the smoke and mirrors, endless war machine charade going... buy US Treasuries and other government bonds. If you want to help defund the clown world... buy Bitcoin. Few understand that it's really this simple.' - Dr. Jeff...