Weekly Recap - 04.12.2023

🧠Quote(s) of the week:

“Here’s the question you must ask yourself: Do you trust a group of unelected, corrupt old central bankers to completely control the value of your money? That’s fiat. Or do you trust energy, math, and the free market? That’s Bitcoin” – Walker

“No one will exchange their Bitcoin for less than $1 ever again. That ship has sailed.

No one will exchange their Bitcoin for less than $10 ever again. That ship has sailed.

No one will exchange their Bitcoin for less than $100 ever again. That ship has sailed.

No one will exchange their Bitcoin for less than $1,000 ever again. That ship has sailed.

No one will exchange their Bitcoin for less than $10,000 ever again. That ship has sailed.

How much longer before no one will exchange their Bitcoin for less than $100,000 ever again? That ship will soon sail.” – Wicked

🧡Bitcoin news:

➡️ “El Salvador, in partnership with Tether, launches its “Freedom Visa” program that will offer residency and a pathway to citizenship for investors who commit $1 million in Bitcoin or USDT.

This program, limited to 1,000 participants yearly, aims to attract wealthy individuals by offering residency and eventual citizenship in exchange for their investment. This follows El Salvador’s decision to make Bitcoin legal tender in 2021.

The initiative, seen as a significant opportunity for investors to contribute to El Salvador’s future, requires a substantial investment for citizenship eligibility. Adriana Mira, the Vice Minister of Foreign Affairs, emphasizes the program’s potential to shape the nation’s future. The program is expected to generate around $1 billion annually and has Tether, the world’s largest stablecoin issuer, as a technology partner. The high investment threshold has not deterred interest, with strong demand reported for the program.” h/t Scott Melker

Of course, this is a bit expensive for a new passport haha, but make no mistake. Game theory is at play here. The future competition over top talent / wealthy entrepreneurs will be fascinating to watch unfold.

➡️ Decentralized Bitcoin exchange Bisq sees a significant increase in Exchange Trade Volume.

Love to see it!

➡️ Bitcoin has surged 166% since the European Central Bank said it was on the ‘road to irrelevance’

➡️The New Hampshire Commission on Nuclear Energy produces a report on “Next-Generation Nuclear Reactor Technology” which mentions Bitcoin over 40 times.

Full report available at the commission website. Report: https://nuclearnh.energy/wp-content/uploads/2023/12/NH-Nuclear-Study-Commission-2023-Final-Report.pdf

➡️Mining Stocks Year-to-Date: Bitfarms $BITF: +382% Iris $IREN: +377% CleanSpark $CLSK: +354% Marathon $MARA: +349% Riot $RIOT: +339% Hive $HIVE: +173% Hut8 $HUT: +123% $BTC: +161% (data: Yahoo Finance)

https://twitter.com/rektbuildr/status/1732542258698694875

If you have a Ledger you might want to consider another hardware wallet, you should at least stop using Ledger Live and switch to Sparrow Wallet.

When it comes to privacy and potential downsides of Ledger in the future, I would not recommend Ledger anymore.

In summary / Red flags for Ledger:

User data leaked (3rd party – supplier got hacked). Now people are being scammed or harassed by phone. It’s not entirely Ledger’s fault, but still very unpleasant.

Marketing/gear: Caps and chains to hang or store your ledger in. In my opinion, it makes no sense for a company, especially a hardware company, to sell such merchandise. It goes against the ethos of Bitcoin/Cypherpunks regarding privacy.

Closed source – in short, you preferably want a hardware wallet that is open source. Like the hardware wallets mentioned below.

Recovery service is perhaps my biggest concern. Ledger can/does possess your private key. This could, for example, be given away if a government were to intervene. Or if a server at Ledger were to be hacked, your private key could (theoretically) be stolen.

Which hardware then?

Blockstream Jade for affordability, Bitbox02 (Bitcoin only or the multi-edition if you have shitcoins), Foundation Passport for user-friendliness, Seedsigner for trustlessness.

Order your Jade here

Order your BitBox 02 Bitcoin Only here

But when it comes to privacy and potential downsides of Ledger in the future, I would not recommend Ledger anymore.

Great reply by BitBox:

https://twitter.com/BitBoxSwiss/status/1733263812311064868

➡️ The Financial Times says “Everything has been thrown at Bitcoin and it’s held up. Whether you like it or not, Bitcoin going to command a place in portfolios”

Bloomberg, Aaron Brown a former head of financial market research at AQR Capital Management, says “Even skeptical investors should accept it’s safer to have a small allocation to Bitcoin than to ignore it”.

Hello, narrative shift!

➡️ The VanEck spot Bitcoin ETF ticker will be $HODL. “VanEck’s bitcoin ETF ticker will be $HODL.. a departure from the more boring Boomer-y choices from BlackRock, Invesco, and Fidelity. Who knows though, maybe smart to differentiate here. Plus, VanEck specializes in niche and has a solid retail base.” – Eric Balchunas

Talking about VanEck, they just released their 15 predictions for 2024:

“The US recession will finally arrive, but so will the first spot Bitcoin ETFs. Over $2.4B may flow into these ETFs in Q1 2024 to support Bitcoin’s price.”

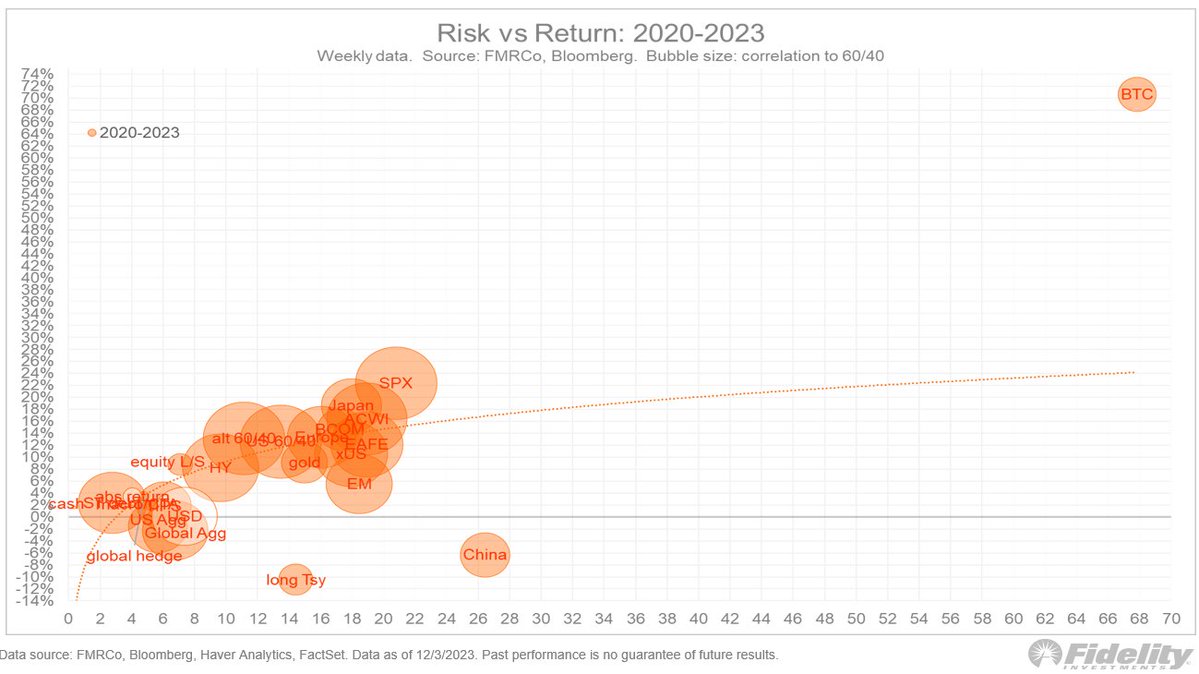

➡️$4.5 trillion Fidelity Director of Global Macro, Jurrien Timmer, says owning a little Bitcoin “could go a long way.”

Owning 0 Bitcoin is irresponsible. The writing is on the wall.

A couple of days later Jurrien dropped another great Bitcoin thesis:

https://twitter.com/TimmerFidelity/status/1732847992183349706

Look at the following chart…and connect the dots.

https://twitter.com/WClementeIII/status/1733178059602231303

https://twitter.com/WClementeIII/status/1733180221048713614

If you want to read the full report; https://www.fidelitydigitalassets.com/sites/default/files/documents/valuing-bitcoin-report.pdf

➡️Cathie Wood says a Bitcoin ETF is the ‘final seal of approval’ for institutions, that will drive the price higher for “5 to 10 years”.

➡️Bitcoin mining company Riot Blockchain acquires 66,560 ASICs from MicroBT for a staggering $290.5M, averaging around $4,360 per machine

➡️Jack Dorsey / BitKey launched their new hardware wallet: https://twitter.com/DocumentingBTC/status/1732803467775795220

“We’re excited to announce people in 95+ countries can now pre-order Bitkey! Bitkey is a self-custody bitcoin wallet with an app to send on the go, hardware to protect your savings, and recovery tools in case you lose your phone, or hardware, or both.”

The following threads are important to read before you decide to buy the Bitkey:

“Mainly concerned here that people won’t grasp that a U.S. publicly traded company will get 100% visibility into their transactions whenever Bitkey is involved. Initial thoughts below:

Pros:

1. Interesting and well-thought-out backup architecture (with major con below) that is very detailed and publicly published (https://bitkey.build/content/files/2023/11/Bitkey-Recovery-Features.pdf

2. Gets many more people thinking about self-custody in Bitcoin

Cons:

1. Not open source software/hardware

2. No clear commitment to open-source software/hardware made

3. Block gets 100% visibility into all transactions due to 2-of-3 multi-sig architecture

4. No ability to verify addresses or amounts (no screen)

5. Still $150 + shipping w/o screen” – SethforPrivacy

Please also read a well-thought-out thread on their screen-less architecture by Zach Herbert that is worth a read for broader context:

https://twitter.com/zachherbert/status/1674532618644144128

For me it sounds like moving it to BitKey won’t be that big of an improvement.

I think Bitkey is positioning itself as an entry-level self-custodial option for customers who don’t care about their privacy. They just want ease of use.

➡️Companies in Japan would no longer have to pay tax on unrealized cryptocurrency gains if they hold on to the digital assets under a proposal being discussed by the country’s ruling coalition.

Source

“People in this space have been talking about this game theory playing out (no tax on gains) for nearly a decade at this point. Tick Tock Next Block” Preston Pysh

I love the game-theory angle. Game theory is the probability of an outcome given human behavior. We are more primal than we think and therefore quite predictable. That would accelerate adoption dramatically. I would use Bitcoin as much as possible if I didn’t have to worry about capital gains tax.

➡️The following article by Preston Pysh is especially for my US followers, but make no mistake Europe/World you can learn from this.

This article by Preston Pysh is an insanely comprehensive takedown of FinCEN’s recent Patriot Act anti-privacy reporting requirements proposal:

https://egodeath.capital/blog/fincen-may-be-violating-your-rights-bitcoin

Context: Recently the Financial Crimes Enforcement Network (FinCEN) has proposed FINCEN-2023-00016. This robust policy proposal is a gross overreach of your freedoms as an American, and this analysis intends to document where, how, and what you do about it.

This article clearly explains 1) what this repressive action by the state means to you and 2) how to easily add your voice to stop it.

➡️ JPMorgan CEO Jamie Dimon says he would “close down” Bitcoin if he were the government. “The only true use case for it is criminals, drug traffickers, money laundering, tax avoidance.”

Watch my response on Instagram or Nostr:

https://www.instagram.com/p/C0hitu6M4Cx/

https://iris.to/note1wylqln56cxrjzydfzrcddecqsqmkjtjgw57frue6mhsayftrwrmq7qhuy4

If you are too lazy to watch the clip 😉

Context: JPMorgan Chase’s parent company is the second most penalized financial institution with close to $40 Billion in fines for 272 violations since 2000. Fines for securities abuses, cheating worker pay, anti-competitive practices, currency manipulation, predatory lending practices, and gross misconduct. They are the criminals and they have no moral authority to stand on when it comes to Bitcoin.

I quote Guy Swann: In other words: “Anyone who uses a tool that I don’t have control and total surveillance of, is de facto committing a crime.” “All tech that works without me as a gatekeeper should be illegal.” Bitcoin exists to protect us from these exact sorts of sociopaths.”

Oh by the way: Jamie Dimon (Oct 17, 2017): “When I made that stupid statement… called [Bitcoin] a fraud, my daughter sent me an email saying, ‘Dad, I own 2 bitcoins.'” Jamie wants to implicate his own daughter as a criminal because he’s embarrassed she has outperformed him by nearly 900%”

➡️BlackRock receives $100K as “seed capital” for its spot Bitcoin ETF, selling 4K shares at a per-share price of $25.00. A flood of money will pour in!

➡️ This is a horrendous level of centralization within the proposed Bitcoin ETFs. It seems Fidelity is the only one doing it right.

Traditional Finance & Macro/Geopolitics:

💸Traditional Finance / Macro:

👉🏽Week ahead: In the US, the highlights will be CPI, retail sales, and industrial production data, along with the final FOMC meeting of the year. In Europe, we have industrial production data and the ECB and BOE meetings. In Asia we have China monthly activity data, the Japan Tankan report, India industrial production and CPI data, and central bank meetings in Taiwan and the Philippines.

🏦Banks:

👉🏽”UNREALIZED losses US Banks Up 22% to USD 683.9 billion in Q3! We’ll need BTFP 2 soon, Jerome. Let’s just change it to the Bank Forever Funding Program (BFFP) to make things simpler.” This was the text from last week’s weekly recap, let’s have a look at the current state of unrealized losses:

https://twitter.com/AndreasSteno/status/1733196154643358155

The BTFP is scheduled to end on March 11, 2024, FYI, this won’t end, they will just extend the program.

🌎Macro/Geopolitics:

👉🏽Ever widening wealth inequality on steroids: Since 2000: 132,000 households have added $14 trillion in total wealth while 66,000,000 households have added $2.5 trillion in total wealth. Since Covid $5 trillion went to the top 0.1% while $1.5 trillion went to the bottom 50%.

https://twitter.com/NorthmanTrader/status/1732492229715919126

America’s retirement problem in a nutshell: 1) too little saved (remember this $107k is a mean, not a median) 2) it’s not growing (in nominal terms!) 3) while the cost of living is up over 19%+ since 2020 (according to govt numbers, which likely underreport).

“The result: A decades-long shrinking of the middle class. And nothing, no party, no policy has changed this structural trend. People scream at the right & and the left. Yet the result is always the same. Why? Because the Fed’s policies disproportionately benefit the asset owners.” – Sven Henrich

I have one word for you: Cantillion Effect.

This will lead to social and political instability/fragmentation which we are already in the midst of. The unfair and accelerating concentration of wealth is breaking the social contract. Now read the first quote at the top of the blog post.

👉🏽 “Job growth in the US labor market is set to turn negative in 2024. Since the Fed started raising rates in March 2023, job growth has moved in a straight line lower. Currently, the 3-month moving average of job growth is down to ~200,000. The Fed has maintained the view that weakness in the labor market is likely needed to tame inflation. We expect to see the unemployment rate approaching 5% in 2024.” – TKL

👉🏽”Pending home sales just hit their lowest level in history. In October, US pending home sales fell 1.5% putting sales down 6.6% over the last year. This also marks the 23rd STRAIGHT decline in US pending home sales. To put this in perspective, pending home sales are more than 10% BELOW what they were in 2010. They are also ~3% below the pandemic low when the global economy was in lockdown. All mortgage demand is at its lowest levels since 1994. The housing market is coming to a complete halt.” -TKL

No worry! we aren’t in a recession and we will have a “soft landing”, right? The economy, the real economy is not going to withstand this much longer. “The full effects of the Feds rate hikes are yet to be felt” Jpow

So what can the Fed do…?

👉🏽 Odds of rate cuts beginning as soon as January 2024 are rising quickly. There is now a ~15% chance of rate cuts beginning next month. The base case shows a ~56% chance of rate cuts beginning in March 2024. Markets are currently expecting a total of FIVE 25 basis point rate cuts in 2024. Still, the Fed has yet to discuss the possibility of any rate cuts at all. Markets are fully bought into the “Fed pivot.” – TKL

(foto)

Oh by the way regarding the soft landing shenanigans:

👉🏽 https://twitter.com/MichaelKantro/status/1733145538348916875

We have heard this before, right?

Nov 29, 2006: “Fed Chief Optimistic of Soft Landing With Eye on Inflation and Jobs, Bernanke Remains Upbeat”

👉🏽Are we in a bubble? You tell me,..whooozzaaa! QE is a helluva a drug!

https://twitter.com/NorthmanTrader/status/1732781675803734470

👉🏽The U.S. employment diffusion index dropped to 57.8 in November, reaching a new low in over three years. This signifies a decrease in the number of industries experiencing positive job growth

👉🏽The US economy added 199,000 jobs in November, above expectations of 180,000. The unemployment rate fell to 3.7%, below expectations of 3.9%. This means that the US economy has now added jobs for 35 consecutive months.

👉🏽https://twitter.com/NorthmanTrader/status/1732860857409806725

This is safe. We are fine.

👉🏽 https://twitter.com/LynAldenContact/status/1733525036621758833

Just look at the picture. The money went into the financial system (economy), not the consumer (real economy).

A lot of people are mixing that up. The value of the economy is not based on the PE of stock or the value of stock… above picture and text really puts the debasement (ergo: robbery) of the working class into context. Now look at my first point of this segment.

👉🏽Ray Dalio warns that the United States is on the verge of a sovereign debt crisis, citing weakening demand for U.S. Treasuries.

👉🏽 “According to Apollo, the debt-to-GDP ratio in the US is on track to hit 200% within the next 15 years. Less than 20 years ago, the debt-to-GDP ratio was just ~50%. The current debt-to-GDP ratio in the US is at 120%, nearly 2.5x what it was before 2008. To put this in perspective, even in World War 2 the debt-to-GDP ratio peaked at 106%, below current levels. 2024 will be the first year with over $1 trillion in interest expense.” -TKL

To summarize everything discussed above, just have a look at the following tweet.

https://twitter.com/jameslavish/status/1733535612744216577

👉🏽”One of Germany’s main political parties, the CDU, has gone all in on supporting nuclear!! (Article linked here)

Their demands:

1) Join the (over) 22 countries (for example the Netherlands) that have pledged to triple nuclear capacity by 2050.

2) Restart six of Germany’s closed plants.

3) Build new, “next generation” reactors.”

The funny thing about this is that the CDU decided to end the nuclear times in Germany in 2011. So for now let’s see if they really talk the talk, walk the walk.

Going to leave this here, without promoting one side of the political spectrum over the other:

https://twitter.com/MichaelAArouet/status/1733456315039481997

👉🏽Javier Milei has officially been sworn in as President of Argentina. His official signature in the inauguration book says: ”VIVA LA LIBERTAD CARAJO” English translation: “Long Live F*cking Freedom”

On the night before @JMilei’s inauguration, Argentines are gathering outside of the Central Bank to do a candlelight wake and say goodbye to it.

🎁If you have made it this far I would like to give you a little gift.

I want to share a great article by Preston Pysh on how to ACTUALLY get free speech on social media.

https://bitcoinmagazine.com/technical/preston-pysh-how-to-actually-get-free-speech

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The Relai app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy.

For new users, the app can be downloaded from all Play Stores. The iOS version is only available in Swiss, Austrian, German, and Italian App Stores. If you set up a Bitcoin Savings Plan (weekly/monthly) you can use my code CRYPTOFRIDAY and your fees will be reduced by 0.5%!

Check out my tutorial post (Instagram) & video (Youtube) for more info. ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple. ⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it!🧡

Or support my work with Bitcoin:

Disclaimer: This article should not be taken as, and is not intended to provide any investment advice. It is for educational and entertainment purposes only. As of the time of posting, the writer(s) may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency, as all investments contain risk. All opinions expressed in these articles are my own and are in no way a reflection of the views of the used sources.

Latest articles:

The Latest Bitcoin & Macro news: Weekly Recap 30.07.2024

🧠Quote(s) of the week: 'In a world of exponentially growing trust problems, it is prudent to own Bitcoin, the only asset that requires zero trust.' -James Lavish 'Bitcoin is a tool for: Financial inclusion Banking the unbanked Eliminating financial discrimination...

The Latest Bitcoin & Macro news: Weekly Recap 22.07.2024

🧠Quote(s) of the week: 'The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.' -Nassim Taleb 🧡Bitcoin news🧡 Now before I start with the Weekly Recap I want to...

The Latest Bitcoin & Macro news: Weekly Recap 15.07.2024

🧠Quote(s) of the week:'If you want to keep the smoke and mirrors, endless war machine charade going... buy US Treasuries and other government bonds. If you want to help defund the clown world... buy Bitcoin. Few understand that it's really this simple.' - Dr. Jeff...