Weekly Recap - 05.02.2024

🧠Quote(s) of the week:

“FED Chair, Jerome Powell on the US national debt:

• We’re on an unsustainable path

• Debt is growing faster than the economy

• We’re borrowing from future generations

Projected debt in 30 years: $144 Trillion”

We need Bitcoin now more than ever!

🧡Bitcoin news🧡

➡️ Satoshi Act Fund aids in introducing pro-Bitcoin legislation in Tennessee, marking the fifth state this year so far. The bill safeguards the rights to custody, mine, and run a node.

The Governor of Texas announced, “We want to be the home of innovation and Bitcoin is the cutting edge of innovation”.

➡️ Ark Invest’s “Big Ideas 2024 research report visualizes the long-term returns of buying and holding Bitcoin.

“Historically, investors who bought and held bitcoin for at least 5 years have profited, no matter when they made their purchases.” Next to that according to ArkInvest’s “Big Ideas 2024” report, the price of 1 Bitcoin is projected to reach $2.3 million if 19.4% of the $250 trillion global investable asset base is allocated to Bitcoin.

➡️All-Time High for Bitcoin Network Difficulty & New Record Bitcoin Hashrate! 550,000,000,000,000,000,000x per second

➡️A report by the US Energy Information Administration (EIA) reveals Bitcoin mining uses 0.6-2.3% of US electricity, and 0.2-0.9% globally.

2% to secure the world’s next reserve currency. Less than 1% for powering the world with the only truly free, sound version of money while wasting over 1% on appliances like TVs on standby… I’d call that good numbers.

➡️BlackRock’s Bitcoin ETF IBIT now has +$3.1 BILLION Bitcoin in just 3 weeks since launch. They currently hold >72,466 BTC.

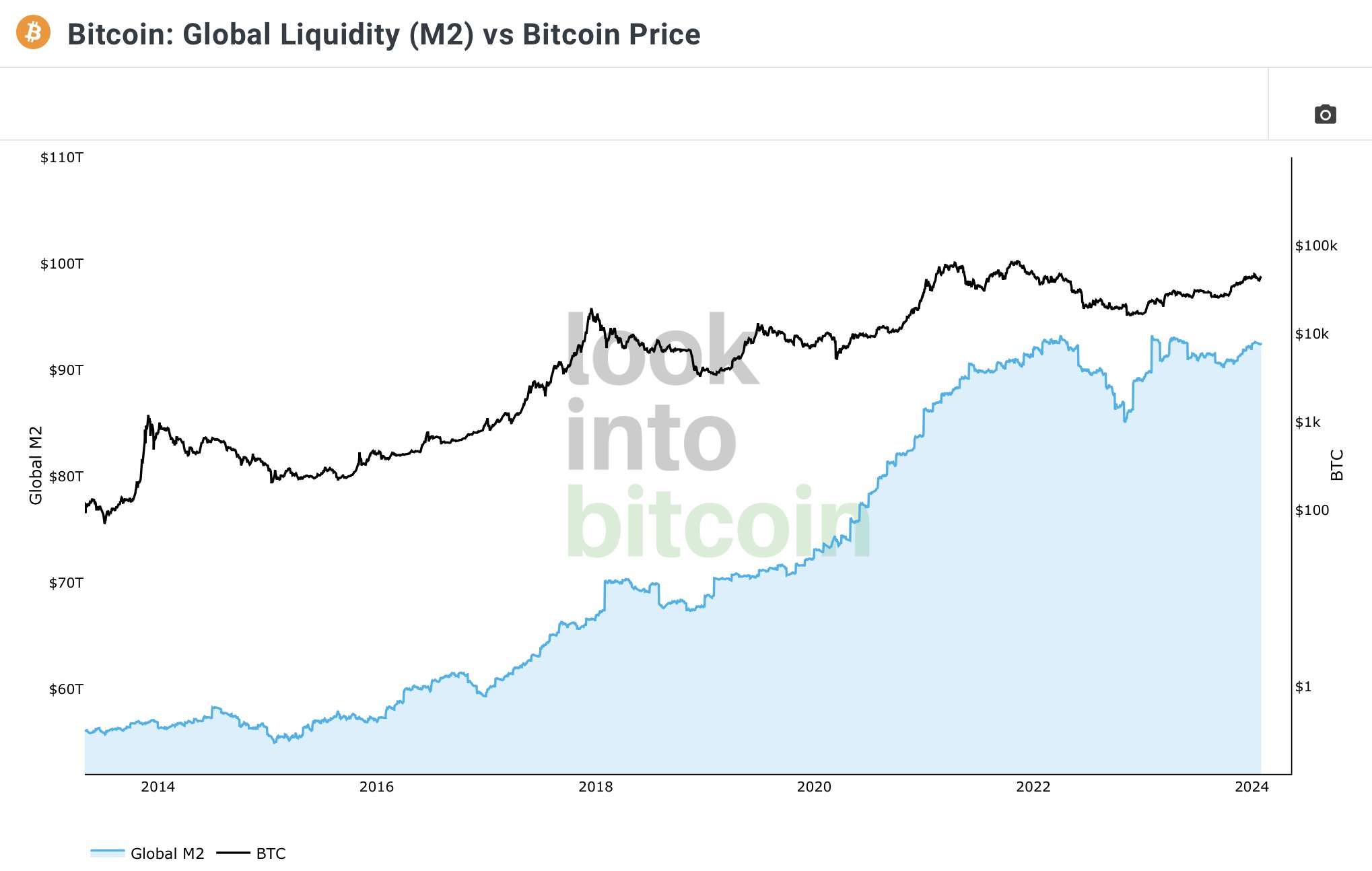

➡️Over the last decade, Bitcoin has ridden on the back of global liquidity as the world’s M2 money supply increased from $56 trillion in 2014 to $92 trillion today. And the printing will only continue, more on that in the segment below (macro-economics)

➡️Cathie Wood’s ARK says optimal Bitcoin allocation for portfolios is 19.4%.

Up 3x from 6.2% in 2022.

➡️The Biden Administration has issued an “emergency” data collection initiative to identify the electricity usage of the Bitcoin mining industry in America

Miners who do not comply are threatened with fines of up to $10,633 for EACH DAY they do not respond

This is the type of stuff you would expect in countries like Iran, North Korea, and China. Countries that would not allow any progress outside what the state deems within its plans for the people. I am sure the EU will follow suit. Unfortunately.

➡️UK police have seized £1.4 BILLIONBitcoin during an attempt to launder proceeds of a £5b investment fraud carried out in China.

➡️Milei strategically removes Bitcoin taxes from the “Ley Ómnibus” reform, aiming for swift approval.

The bill initially demanded the declaration of undeclared assets, including cryptocurrencies.

In his first 50 days as president, this man has:

👉🏽Fired 50,000 government employees

👉🏽Deregulated legal tender laws

👉🏽Abolished taxes on Bitcoin

But sure, Javier Milei is “controlled opposition.”

➡️Someone just moved 35,049 Bitcoin worth $1.5 billion for a transaction fee of $3.21.

➡️According to Tether’s latest Q4 attestation, the company holds $2.8 billion worth of Bitcoin on its balance sheet.

➡️REKT! Great post and great chart for everyone who is considering enjoying the pump & dumps in the world of altcoins. Please reconsider.

The point of this post is that these coins weren’t considered shitcoins by most people, they were contenders to be the next big thing. Almost all shitcoins will trend toward zero, especially as priced in Bitcoin.

https://twitter.com/duczko/status/1752574281610051800

➡️Entities holding at least 1K Bitcoin are up 4.50% over the past two weeks.

➡️Putting it in perspective.

The 9 New ETFs hold more Bitcoin than Tether, Tesla, Block and all the of the Public Miners combined.

Soon they eclipse MSTR. Later GBTC. Regarding GBTC, the dumping of GBTC by FTX is over and bitcoin ETFs see a big whoosh of net inflows.

➡️Education will be the key to resisting CBDCs. Great thread by Daniel Batten:

https://twitter.com/DSBatten/status/1752262434264604844

➡️BlackRock’s Bitcoin ETF becomes first to break $2b in assets and now holds more than 52,000.

➡️https://twitter.com/TuurDemeester/status/1752075827804516392

Please also read Samson Mow’s explanation Tuur is referring to.

Another great explanation by Samson…

➡️UTXO Management for Dummies: If everyone pays you in quarters you’ll have to lug around a big heavy bag. It’ll also cost you more time to spend as you have to count quarters when paying. So ask for $20s or $100s as payment, or change your quarters into bills from time to time.

Now I hear you say…wtf is a UTXO?

A UTXO stands for unspent transaction output. Don’t worry about those unnecessarily complicated words. Just use “UTXO” and understand the concept of what it is…

If you want to learn/study the topic:

➡️ “CBDC Is a calamity for human and civil rights. Bitcoin gives you better protection than cash. It also gives you protection from inflation and all of the other hazards that come along with FIAT currencies,” says US Presidential Candidate Robert F. Kennedy Jr.

➡️”One of China’s largest fund managers, Harvest, to launch a spot Bitcoin ETF in Hong Kong after the Securities Commission said it is ready to accept applications.

China coming to the party!” – Bitcoin Archive

💸Traditional Finance & Macro

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have the service sector ISM report and the Fed’s latest Senior Loan Officer survey. In Europe, the focus will be on German industrial production, the February Sentix survey of investor sentiment, and the latest ECB bulletin. In Asia, we have China CPI and Japan earnings data, along with central bank meetings in India and Australia.

👉🏽Meta just gained $200 billion in market cap.

It’s the biggest one-day gain in stock market history. CEO Mark Zuckerberg stands to receive a payout of ~$700 Million a year from Meta’s first-ever dividend which was announced today – Bloomberg

🏦Banks:

Last week I mentioned that the FED announced that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11.

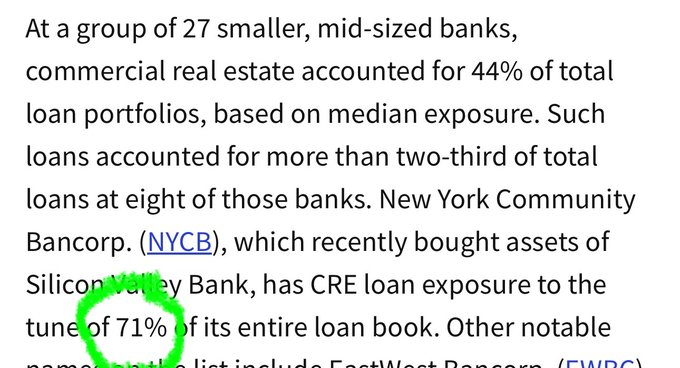

“This week we witnessed how New York Community Bank stock, NYCB, the bank that acquired the collapsed Signature Bank, fell 40% after earnings.

The bank announced they will cut their dividend by 70% to meet regulatory requirements.

They also reported a 4th quarter LOSS of $260 million while expectations were for a GAIN of that size.

This comes just a few weeks before the Fed’s emergency loan program is set to expire. Many of these small banks hold tons of exposure to commercial real estate loans.

70% of all CRE loans in the US are held by small banks.

If CRE project defaults continue, we could see more pressure on banks.” – TKL

Are (small) banks still feeling the pain? I guess so…why? What is predominantly in their (NYCB) loan portfolio? It’s the same thing that’s in basically every bank portfolio – a large % of CRE & USTs? And it is not only in the US.

Shares of Japanese bank Aozora are collapsing. The stock’s on the steepest 2-day drop since it became a public company.

Why? The Bank reported massive exposure to US commercial real estate.

Regarding CRE. “Another sign the Commercial Real Estate (CRE) crisis is worse than we thought?

The Xerox building in Washington DC just sold for $25 million.

It was last purchased for $145 million just over a decade ago, in 2011.

This reflects an 83% LOSS on the 19-story office building.

The buyer of the property plans to convert it to an apartment building.”

“44% of office loans carry outstanding loan balances higher than the property value and are at risk of default according to the NBER.”

🌎Macro/Geopolitics:

👉🏽”SUMMARY OF FED DECISION (1/31/24):

1. Fed leaves rates unchanged for 4th straight meeting

2. The Fed does not expect rate cuts until “greater confidence” inflation is moving to 2%

3. “Highly attentive” to inflation risks with economic uncertainty

4. Job gains have moderated but remain strong

5. Upcoming policy will be based on incoming data

6. Fed sees evolving outlook while balancing risks.

This seems to be a different tone than their December meeting.

Particularly, the new statement about not expecting rate cuts until “greater confidence” about inflation.”- TKL

It seems like they are backtracking. The FED is really caught between a rock and a hard place of its own making.

1. election year pressure to cut rates.

2. Govt cost of debt increasing, pressuring rate cuts. (the banks and national budget, and other parts of the indebted economy)

3. The FED knows inflation still has the potential to tick up.

👉🏽The U.S. added a blowout of 353,000 jobs in January, far above the 185,000 expected.

November and December growth were also revised up substantially. BUT… it seems like all “jobs” added in the past year have been part-time workers.

https://fred.stlouisfed.org/series/LNS12500000

Especially if you read the following bit:

Latest List of Layoffs Over Last 3 Months:

1. Twitch: 35% of workforce

2. Hasbro: 20% of workforce

3. Spotify: 17% of workforce

4. Levi’s: 15% of workforce

5. Zerox: 15% of workforce

6. Qualtrics: 14% of workforce

7. Wayfair: 13% of workforce

8. Duolingo: 10% of workforce

9. Washington Post: 10% of workforce

10. eBay: 9% of workforce

11. PayPal: 9% of workforce

12. Business Insider: 8% of workforce

13. Charles Schwab: 6% of workforce

14. Macy’s: 4% of workforce

15. Blackrock: 3% of the workforce

16. Citigroup: 20,000 employees

17. UPS: 12,000 employees

18. Deutsche Bank: 3,500 employees

19. Pixar: 1,300 employees

20. Salesforce: 700 employees

21. American Airlines: 650 employees

January 2024 saw a total of 82,000 layoffs, the second-worst January since 2009. Meanwhile, the US just reported that 353,000 jobs were created in January.

The jobs at all of these companies seeing layoffs tend to be full-time, high-pay, high-benefit jobs. The jobs number from yesterday includes many more part-time, lower pay, smaller benefit jobs than the ones mentioned above that have been lost.

If you lose your full-time job and have to take 2 or 3 part-time jobs to keep paying your mortgage, the current administration counts that as job growth.

That’s how messed up the system is right now.

Just going to leave this here:

https://twitter.com/mtmalinen/status/1753700241465835732

👉🏽”BTC has allowed anyone to cut to the front of the “fiat currency Cantillon Effect benefit line”. – yes!!

Please read both tweets: https://twitter.com/LukeGromen/status/1753854390367039907

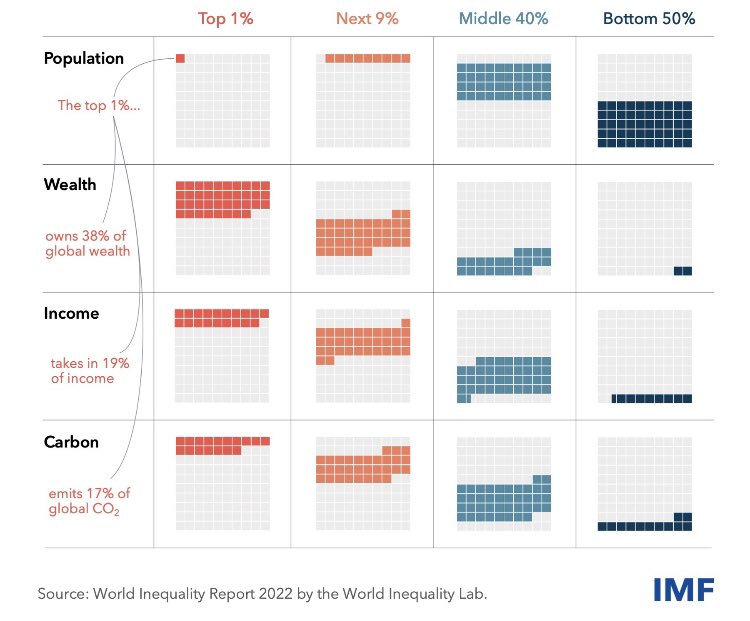

To make it extra ‘special’: “10% of the world‘s population own 75% of all wealth, get 50% of all income and account for nearly half of all CO2 emissions.

source IMF:

👉🏽Germany: Retail sales have fallen by 4.4% in Dec YoY. This means that even Christmas sales fell through. Germans have gone on a buyers’ strike since the outbreak of inflation and have even cut back on gifts for children during the Christmas season. This also explains why Germany has some of the toughest competition in the retail sector and the lowest profit margins there.” Zschaepitz

Basically, all categories are down except gas stations and clothing & textiles. Hello, buyers strike!

German inflation slows to 2.9% in January from 3.7% in December, the lowest level since June 2021. Core CPI slows to 3.4% in Jan from 3.5% in Dec, lowest level June 2022. Energy in deflation, Energy prices dropped -2.8% YoY, while Food CPI slowed to 3.8% from 4.5% in Dec.

👉🏽 The two largest economies in Africa are under huge financial strain.

On the 30th of January, Nigeria de facto devalued the naira by ~30% (after another ~30% devaluation in June). And Egypt is under pressure to devalue too, with the pound ~50% weaker in the black market. The Naira has moved from ~470 vs the USD in June last year to now at 1452 as of the 1st of February.

Bitcoin could step in as an economic life raft. It offers a robust alternative to national currencies prone to devaluation, providing a measure of financial sovereignty to individuals.

I will quote Alex Gladstein on this topic:

“In neither case did the government ask the people for permission to dramatically reduce their wages, purchasing power, or living standards.

Now hundreds of millions will suffer

Currency devaluation is a crime against humanity.”

https://twitter.com/DSBatten/status/1753171731521691872

👉🏽US Treasury Department cuts Jan-Mar borrowing estimate to $760 billion from $816 billion and estimates $202 billion net borrowing for Apr-Jun, per Bloomberg.

Are they smoking crack?

The Treasury has issued $134BN in debt in the past 4 weeks but expects to issue $202BN in all of Q2.

“if anyone expects any econ data in the election 2024 year to be i) accurate or ii) make any sense, you will be severely disappointed.”

👉🏽https://twitter.com/jameslavish/status/1753804440166125702

“We’re getting to the point now where the interest expense on the debt is so high that it’s going to eat up our ability to basically service the next generation”

“I’m not even sure about the current one”

“We are in deep trouble”

“By 2027, the interest expense alone on the debt eats all healthcare spending”

“By 2047, it eats all discretionary spending”

👉🏽”A record $8.9 trillion of government debt will mature over the next year.

Meanwhile, the government deficit in 2024 is projected to be $1.4 trillion.

This means that someone will need to buy more than $10 trillion in US government bonds in 2024.

That’s nearly a third of all outstanding US federal debt right now.

All the while the Fed is expected to start cutting rates, making buying these bonds less attractive.

One of the biggest issues with a higher for the longer environment is US debt.

Debt service costs for the US government have more than doubled since the Fed started raising rates.”

Yesterday Fed Chair Powell said it best himself:

Scott Pelley (60 Minutes): “Is the national debt a danger to the economy in your view?”

Fed Chairman Jerome Powell on the US national debt:

• We’re on an unsustainable path

• Debt is growing faster than the economy

• We’re borrowing from future generations

Projected debt in 30 years: $144 Trillion”

We need Bitcoin now more than ever.

“Under current fiscal policies, the Debt to GDP ratio in the US is projected to hit 200% within 20 years.

Before 2020, Debt to GDP in the US was ~100% and before 2008 it was ~60%.

Current estimates show the US hitting $50 trillion in total debt by 2033.

This means that the US will add $218 million in debt EVERY HOUR until 2033.

Just imagine what would happen if the Fed doesn’t in fact achieve a soft landing.”- TKL

This is unsustainable.

👉🏽Nearly 30% of ALL stocks in China have trading stopped as the CSI 1000 index falls 8%. Healty world economy, right?

🎁If you have made it this far I would like to give you a little gift:

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The Relai app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy.

For new users, the app can be downloaded from all Play Stores. The iOS version is only available in Swiss, Austrian, German, and Italian App Stores. If you set up a Bitcoin Savings Plan (weekly/monthly) you can use my code CRYPTOFRIDAY and your fees will be reduced by 0.5%!

Check out my tutorial post (Instagram) & video (Youtube) for more info. ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple. ⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it!🧡

Or support my work with Bitcoin:

Disclaimer: This article should not be taken as, and is not intended to provide any investment advice. It is for educational and entertainment purposes only. As of the time of posting, the writer(s) may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency, as all investments contain risk. All opinions expressed in these articles are my own and are in no way a reflection of the views of the used sources.

Latest articles:

The Latest Bitcoin & Macro news: Weekly Recap 30.07.2024

🧠Quote(s) of the week: 'In a world of exponentially growing trust problems, it is prudent to own Bitcoin, the only asset that requires zero trust.' -James Lavish 'Bitcoin is a tool for: Financial inclusion Banking the unbanked Eliminating financial discrimination...

The Latest Bitcoin & Macro news: Weekly Recap 22.07.2024

🧠Quote(s) of the week: 'The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.' -Nassim Taleb 🧡Bitcoin news🧡 Now before I start with the Weekly Recap I want to...

The Latest Bitcoin & Macro news: Weekly Recap 15.07.2024

🧠Quote(s) of the week:'If you want to keep the smoke and mirrors, endless war machine charade going... buy US Treasuries and other government bonds. If you want to help defund the clown world... buy Bitcoin. Few understand that it's really this simple.' - Dr. Jeff...