Weekly Recap - 06.05.2024

🧠Quote(s) of the week:

‘Replacing the failed illegal, immoral, illegitimate Ponzi scheme called the US$ is already happening. In case you missed it, the US$ is at least 2 years into an unwinding debt/death spiral that cannot be stopped. Bitcoin replaces the greatest fraud in human history. Period.

The world is moving away from fiat currencies that can be printed and confiscated. While central banks embrace the old (gold) or create a new (digital) fiat-currency (CBDC), I hope the people will be embracing the future with Bitcoin’ -Bitcoin Friday

‘Over the last year, the US Government borrowed approximately $99,802 per second.’ -James Lavish

🧡Bitcoin news🧡

29th of April:

➡️’A solo miner just mined a block worth 3.433 Bitcoin worth $218,544.

The odds of this happening are around 1 in 5,000.’ – Bitcoin Magazine

30th of April:

➡️’Hong Kong Bitcoin ETFs were predicted to have $300 million inflows on the first day.

Instead, they merely had $11m in total trading volume.’

This is in comparison to the $655 million in first-day cumulative volume for the US-based Bitcoin ETFs.

For me, the whole Hong Kong Bitcoin ETF was already way overhyped, but liquidity is liquidity, supply & demand is supply & demand. It is still a demand that wasn’t there before, Bitcoin is a global asset. A bit further in this segment, you will see that the Hong Kong ETF is catching up though.

➡️If you are a lawmaker, think tank, or policymaker, take a look at this important resource from Satoshi Action. Their latest paper, “Promoting State Financial Innovation: Enhancing State Banking Powers,” delves into the federal government’s control over the banking sector and explores potential strategies to counteract these challenges:

https://www.satoshiaction.io/debanking

Thread: https://twitter.com/Dennis_Porter_/status/1785343073490284780

➡️ Coinbase rolled out Bitcoin Lightning Network integration.

➡️’Nasdaq-listed Alliance Resources, a $2.8b coal mining company, is mining Bitcoin and currently holds 425 Bitcoin on its balance sheet. The company has additionally adopted the new FASB accounting standards for its holdings.’ -Dylan LeClair

I am not surprised though, this is just inevitable. Any energy company should follow suit if they have a surplus of energy (stranded energy) you can convert (monetize) that instantly and profitably into cash for your balance sheet. The new FASB standards allowing fair value accounting for Bitcoin will encourage greater adoption.

2nd of May:

‘MicroStrategy launches an enterprise platform for building decentralized identity applications on Bitcoin — MicroStrategy Orange.

The Bitcoin Inscription DID method (did:btc) uses inscriptions in witness data to store and manage DIDs, leveraging UTXOs for DID control.’ – Dylan LeClair.

“The Bitcoin Inscription DID method (did:btc) uses the Bitcoin blockchain exclusively to store and retrieve DID information. UTXOs on the chain are used to control DIDs. Inscribing data in the witness of transactions allows for greater extensibility and verbosity when creating DID documents while reducing fees and block space consumed.”

Source: https://microstrategy.github.io/did-btc-spec/

Personally, I think it is interesting to see MicroStrategy beginning to deploy products for Bitcoin. If that’s a good thing, dunno, I am not a programmer. But this sounds and feels like Nostr, so why not just use Nostr…?

➡️’Jack Dorsey announces that each month Block will be DCA’ing 10% of their monthly gross profit from Bitcoin products into purchases of Bitcoin for investment.

They plan to purchase Bitcoin on a monthly cadence utilizing TWAP orders, starting April 2024.’ -Bitcoin News

➡️Senator Cynthia Lummis dares the US Department of Justice about Bitcoin self-custody.

“COME AND TAKE IT”

Power move, your keys…your coin!

➡️ Sovereign wealth funds, pension funds, and endowments will start trading Bitcoin ETFs in the coming months – BlackRock’s Head of Digital Assets

3rd of May:

➡️’Bitcoin is at 4.7% world adoption, this is the same as Jan 1999 for Internet Adoption.

You are still early… and that’s backed by the best data available.’

This is using the latest data available across many studies. See: https://woocharts.com/bitcoin-total-users/…

– Willy Woo

➡️’Hong Kong asset manager Yong Rong just reported owning $38m of BlackRock’s Bitcoin ETF.

The largest holding by an asset manager in quarterly filings so far.’ – Eric Balchunas

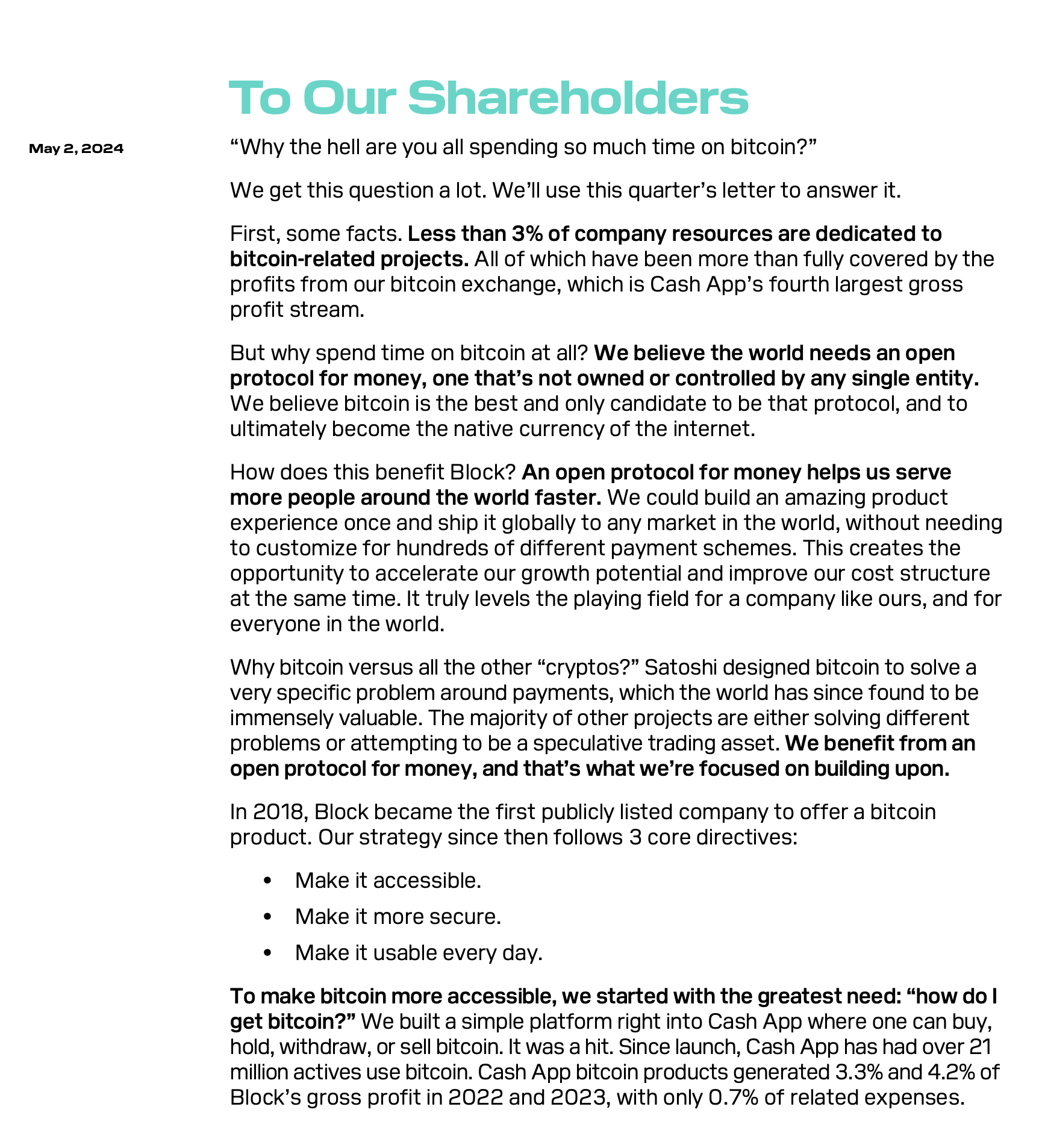

➡️Jack Dorsey pens a letter to shareholders of Block, explaining “why the hell [the company] is spending so much time on Bitcoin.

4th of May:

➡️More on Jack Dorsey, whether you like him or not, Bitcoin is powered by philanthropy, not VC funds.

‘OpenSats has received an additional donation of $21M from startsmall – Jack’s philanthropic initiative.

$15,000,000 going to our General Fund.

$5,000,000 to our Nostr Fund.

$1M to our operations budget.’

This is what ‘putting your money where your mouth is’ looks like. This is massive and extremely generous. A+ for supporting Bitcoin development and Nostr (open protocols).

➡️ ‘Last week on Friday marked the first time none of the Bitcoin ETFs saw negative flows.

In fact, GBTC saw over 4X in the inflows of BlackRock.’ – Bitcoin News

5th of May:

➡️’Total Bitcoin held on exchanges has fallen by 360,000 ($22.9B) over the last year. ‘ -Thomas Fahrer

6th of May:

➡️’Bitcoin whales accumulated 47K Bitcoin in the past 24 hours. We’re entering a new era,” CryptoQuant CEO Ki Young Ju said on Saturday.’ – Bitcoin News

➡️Today an old wallet from 2011 just moved $44 Million worth of BTC. The owner of the wallet hodled all the way from $2 to $65000.

➡️Hong Kong’s new spot Bitcoin ETFs attract $230M in assets under management (AUM) during their first week.

China AMC was the most successful with $116M, followed by Bosera International & HashKey Capital at $57M, and Harvest Global Investment also at $57M.

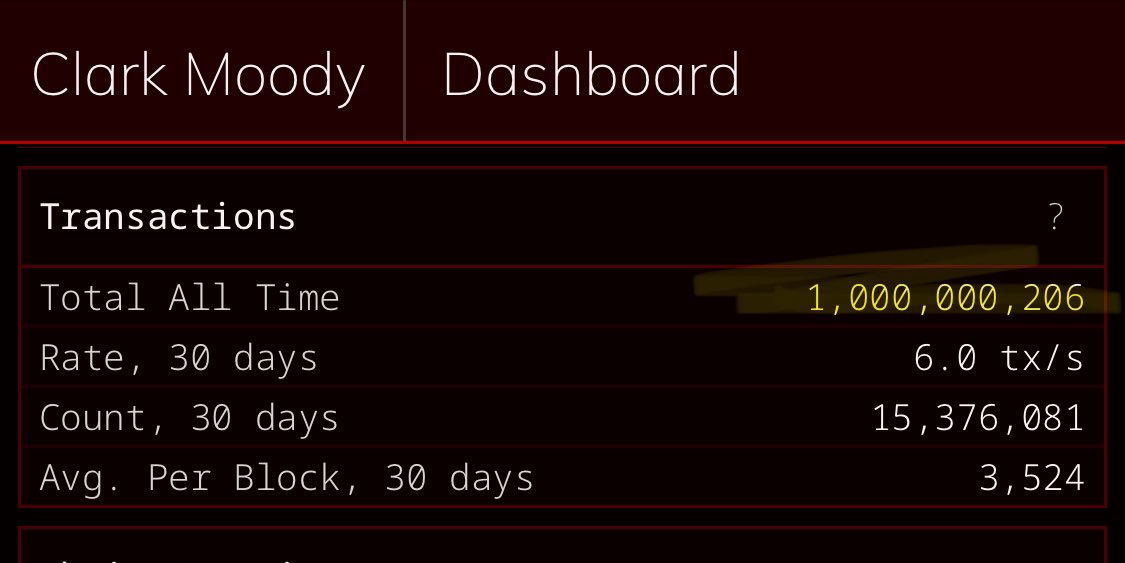

➡️ ‘Bitcoin has officially processed over 1 BILLION transactions all time.’ -Pete Rizzo

💸Traditional Finance & Macro

💸Traditional Finance / Macro:

👉🏽 Berkshire Hathaway’s cash pile reached a new all-time high of $189 BILLION in Q1 2024.

This is a $19 billion increase from their cash balance seen in Q4 2023 and a 70% increase in cash since 2022. To put this in perspective, Berkshire Hathaway’s cash balance is larger than the market cap of Starbucks and Target combined.

When asked about this, Warren Buffet said “I don’t mind at all, given current conditions, building our cash position.” – TKL

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

On the 30th of April:

👉🏽’Current US Debt is 34.7 trillion.

To give an idea of how big that is, if you stacked $1 bills, you would have enough money to stack from here to the moon 9.86 times.

The math below for the data geeks:

The thickness of a US dollar bill is 0.0043 inches.

Average distance to the Moon: 384,400 km.

1 inch = 2.54cm so 1000 dollar bills stacked is 0.0043×2.54×1000 = 10.922cm

so 100,000 is 10.922m

so 100,000,000 is 10922m (10.92km)

so 100,000,000,000 (100 billion) is 10922 km

so 1,000,000,000,000 (1 trillion) is 109,220km

so 34.7 trillion is 34.7×109,200 = 3.790million km =

9.86 trips to the moon.’

9 times people, too big to comprehend and everyone just thinks: ‘Oh well. Doesn’t affect me.’

The debt will get bigger & bigger and the Ponzi scheme will keep going as long as citizens stay uneducated regarding Monetary History and what money is. The fall of empires (the Romans, the Dutch, the UK, and now the US) is directly correlated to the debasement of money.

On the same day…

👉🏽US TREASURY SECRETARY YELLEN: I AM CONCERNED ABOUT WHERE WE’RE GOING WITH THE US DEFICIT.

The main question should be…at what point are they alarmed or panicked? And when the shit is hitting the fan are they going to warn you?

Just a thought.

1st of May:

👉🏽’The US economy LOST 192,000 jobs in Q3 2023, according to the BED report released by the BLS last week.

BED data tracks quarterly changes in employment at all private businesses in the US economy.

Meanwhile, US nonfarm payroll data showed that the US labor market added 494,000 new jobs in Q3 2023. This is a WHOPPING 686,000 difference in job count over just one quarter.

The BED data from the BLS suggests that the final labor market revisions released in 2025 will be MUCH lower than the headline-reported job numbers.’- TKL

TLDR: The numbers are fake. What is happening is outright data manipulation and nobody gaslights harder than the government… apparently or they aren’t capable enough. Pick one.

‘US Treasury announces first treasury buyback operation since 2002

The US Treasury is launching its first buyback program since 2002, scheduled to start on May 29, 2024. The program is designed to improve liquidity in the Treasury market and is expected to run through July 2024. During this period, the Treasury plans to hold weekly liquidity support buybacks of up to $2 billion per operation, with up to $500 million allocated for TIPS (Treasury Inflation-Protected Securities). This initiative aims to ensure the Treasury market remains the deepest and most liquid in the world, addressing concerns about market functioning and resilience.’ – MartyParty

IMO: This is a bank bailout. Treasury QE is on its way.

3rd of May:

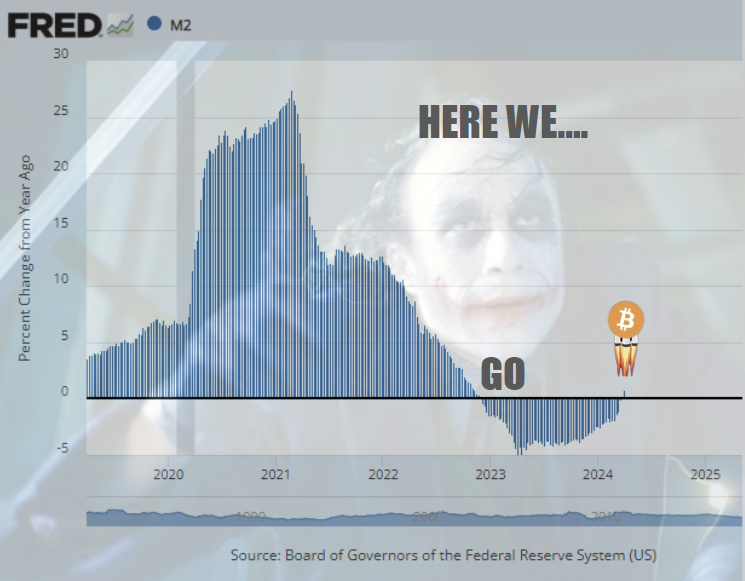

👉🏽M2 Money Supply has flipped positive.

The last time M2 increased, the Bitcoin bull market ripped.

👉🏽Everyone and their mother is talking about unsustainable US fiscal deficit and debt.

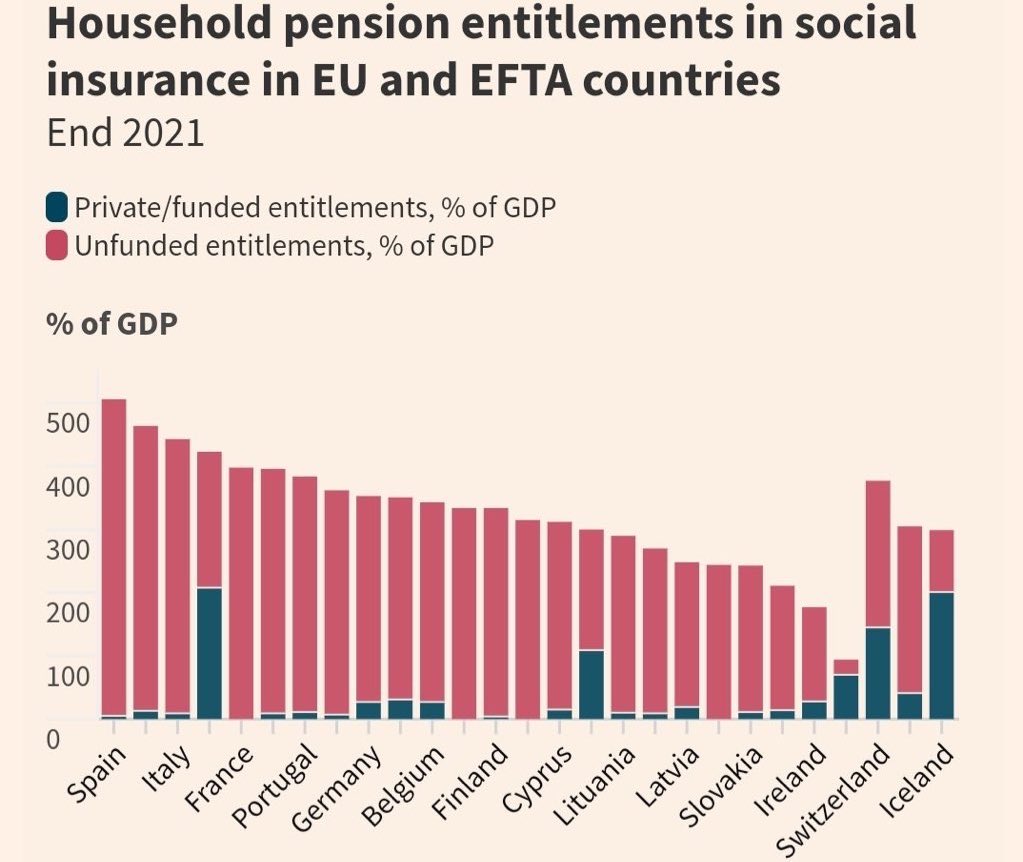

Take a look at off-balance-sheet pension entitlements in Southern Europe at 500% of GDP. Combined with collapsing demographics it’s a severe debt crisis in the making. What’s the solution? – Michael A. Arouet

Why Bitcoin is my pension. Well, most of the people in my generation understand that the pension system is a Ponzi scheme. The boomers enjoy on average 1800 €/month pension. My generation might get even more in nominal terms in 20 years, but the real purchasing power of those future pensions is weak to at least. With Bitcoin, my purchasing power is getting better and better. As a European with kid(s)…the solution is leaving at some point before the collapse because they probably will port over the Dutch pensions into the European ones. The question is though, where? With Bitcoin, I will grant myself and my family some optionality.

👉🏽”This is absolutely priceless. And probably the most frightening clip you’ll ever watch on the people in charge of the US economy.

Jared Bernstein is literally the Chair of the Council of Economic Advisers, the main agency advising Biden on economic policy, and he can’t even explain why governments borrow money in the currency they print out of thin air.

https://twitter.com/RnaudBertrand/status/1786277466824466896

It’s a clip from the award-winning documentary “Finding the Money”. – Arnaud Bertrand

Honestly one of the best motivational speeches for Bitcoiners I’ve ever seen. When this is all said and done everyone will agree once again that fiat money is a Ponzi and pretend like they held that opinion the entire time. If this video doesn’t convince you to buy Bitcoin you’ll never understand it.

4th of May:

👉🏽’The cost of buying a home in the US rises to $2,750/month, the second highest ever recorded, according to Reventure.

Before the pandemic in 2022, the average home in the US would cost $1,400/month.

In other words, it is now 100% MORE expensive to buy a home in 2024 compared to 2020.

Even at the peak of the 2008 Financial Crisis, the average home payment peaked at $1,550/month.

The average US family would need to spend 44% of their PRE-TAX income to buy a home today.’ -TKL

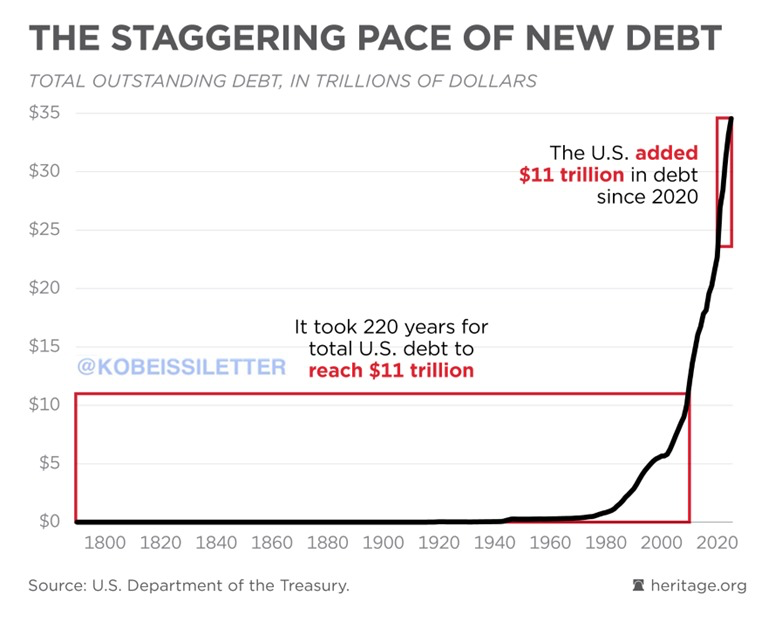

Remember: The United States dollar has lost over 25% of its purchasing power since January 2020. The US government has issued a whopping $11 TRILLION of debt over the last 4 years.

By comparison, it took the US 220 years to add the first $11 trillion of Federal debt.

Unsustainable!

👉🏽The US has added $100,000 in Federal debt EVERY SECOND over the last year.

Since March 1st, the US has been adding a staggering $10 billion in debt PER DAY.

That’s $417 million per hour, $6.9 million per minute, and $115,740 per second.

As interest rate cuts are priced out, we could see $1.7 TRILLION in annual interest expense just one year from now.

Even if the Fed cut rates 6 times this year, interest expense will still hit $1.2 trillion next year.

Ironically, the US government needs lower interest rates more than anyone.

And in March, the Treasury Department paid out about $89 billion in interest to debt holders — or roughly $2 million per minute.

Source: https://archive.ph/7MzeX

🎁If you have made it this far I would like to give you a little gift:

Great panel discussions:

Anyway, that’s it for today.

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The Relai app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy.

For new users, the app can be downloaded from all Play Stores. The iOS version is only available in Swiss, Austrian, German, and Italian App Stores. If you set up a Bitcoin Savings Plan (weekly/monthly) you can use my code CRYPTOFRIDAY and your fees will be reduced by 0.5%!

Check out my tutorial post (Instagram) & video (Youtube) for more info. ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple. ⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it!🧡

Or support my work with Bitcoin:

Disclaimer: This article should not be taken as, and is not intended to provide any investment advice. It is for educational and entertainment purposes only. As of the time of posting, the writer(s) may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency, as all investments contain risk. All opinions expressed in these articles are my own and are in no way a reflection of the views of the used sources.

Latest articles:

The Latest Bitcoin & Macro news: Weekly Recap 30.07.2024

🧠Quote(s) of the week: 'In a world of exponentially growing trust problems, it is prudent to own Bitcoin, the only asset that requires zero trust.' -James Lavish 'Bitcoin is a tool for: Financial inclusion Banking the unbanked Eliminating financial discrimination...

The Latest Bitcoin & Macro news: Weekly Recap 22.07.2024

🧠Quote(s) of the week: 'The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.' -Nassim Taleb 🧡Bitcoin news🧡 Now before I start with the Weekly Recap I want to...

The Latest Bitcoin & Macro news: Weekly Recap 15.07.2024

🧠Quote(s) of the week:'If you want to keep the smoke and mirrors, endless war machine charade going... buy US Treasuries and other government bonds. If you want to help defund the clown world... buy Bitcoin. Few understand that it's really this simple.' - Dr. Jeff...