Weekly Recap - 18.09.2023

🧠Quote(s) of the week:

“I am a Bitcoin maxi because:

1. Economic systems converge on one monetary tool.

2. Bitcoin is immutably scarce.

3. Bitcoin has the least future uncertainty.

4. Altcoin monetary policy is more mutable than BTC.

5. Altcoins decay against BTC in the long run.” – Joe Burnett

“All of the relentless plebs who’ve been daily DCAing Bitcoin since the ATH are once again in profit and the fiat maxis are still completely clueless about how saving in hard money works” – Wicked

🧡Bitcoin news:

➡️ The number of long-term Bitcoin Hodlers continues to hit new all-time highs. It seems like they are accumulating for the next bull run. Over 57% of Bitcoin in the network have not moved their capital in over 2 years.

The number of Bitcoin Addresses Holding 0.1+ Coins just reached an ATH of 4,486,752.

➡️$1.5 Trillion Asset Manager Franklin Templeton has filed for a spot Bitcoin ETF.

After the news came out CNBC had an item on Bitcoin:

Bitcoin “outperformed every asset on the 1 year, 5 year, and 10 year.” “BlackRock and all the folks we thought were never going to do this are doing it” “It’s becoming institutionalised”

“The pressure is now firmly on the SEC to approve a Bitcoin ETF.

-Wall Street wants it (BlackRock, Fidelity, et al)

-Court rules against SEC rejection as illogical, capricious, and arbitrary.

-CNBC has pro-Bitcoin panelists openly advocating for Bitcoin” – Bitcoin Archive

➡️Last week we had the former President of PayPal talking on CNBC about Bitcoin to make the $7.5 trillion daily foreign exchange market a much more efficient and profitable place.

For me, the two things that got me excited are:

1. The former President of PayPal and creator of the Libra project at Meta is focusing his time and energy on Bitcoin & and lightning.

2. A conversation about lightning is being held in mainstream media.

“We’re trying to turn Bitcoin into a global payment network. There’s no universal protocol for money on the internet that enables value to be transported,” says @lightspark CEO David Marcus

➡️ Last week the team of 21Bitcoinapp released a new update.

Features at a glance:

⚡️ Bitcoin 24/7 instant purchase & savings plan

🏦Free real-time transfers up to €100,000.00 (SEPA Instant)

📈Graphic price orders – trade on your terms

🔒Non-custodial mode – full control & security of your Bitcoin

✨ Redesigned user interface for an even more intuitive user experience

Easy integration with tax software

This Bitcoin investment app (KYC) is especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly, and limit orders (24/7). With our code CRYPTOFRIDAY, you permanently pay 20 basis points less in fees.

You can download the app here.

➡️ Coinbase finally will integrate Lightning on their platform. Brian Amstrong, CEO of Coinbase, confirmed the US’s largest (shitcoin casino) crypto exchange will integrate Lightning. The implementation date remains undisclosed.

I can say a lot of things, end of the day Bitcoin is getting more and more traction.

Ok…let me say one thing. Still, Coinbase needs to drop all the shitcoins whose narratives eventually will be destroyed.

➡️ $1.4 trillion giant Deutsche Bank to hold Bitcoin and crypto for institutional clients. The largest bank in Germany, Deutsche Bank, is officially partnering with Taurus to provide crypto custody and tokenization services. Indeed, the bank has tabbed the Swiss firm after participating in its $65 million Series B funding Round. – Reuters

➡️ Bitcoin mining uses 58% clean energy – Bitcoin Mining Council

Today Bloomberg Intelligence reported that Bitcoin Mining uses energy that is +50% from sustainable sources.

The data above attest to the Bitcoin industry’s reputation as one of the most sustainable industries worldwide.

It is impressive to see Bitcoin mining using more and more clean energy. The narrative around Bitcoin and Bitcoin mining is shifting. Who would have thought Bloomberg would publish something positive about Bitcoin (mining)?

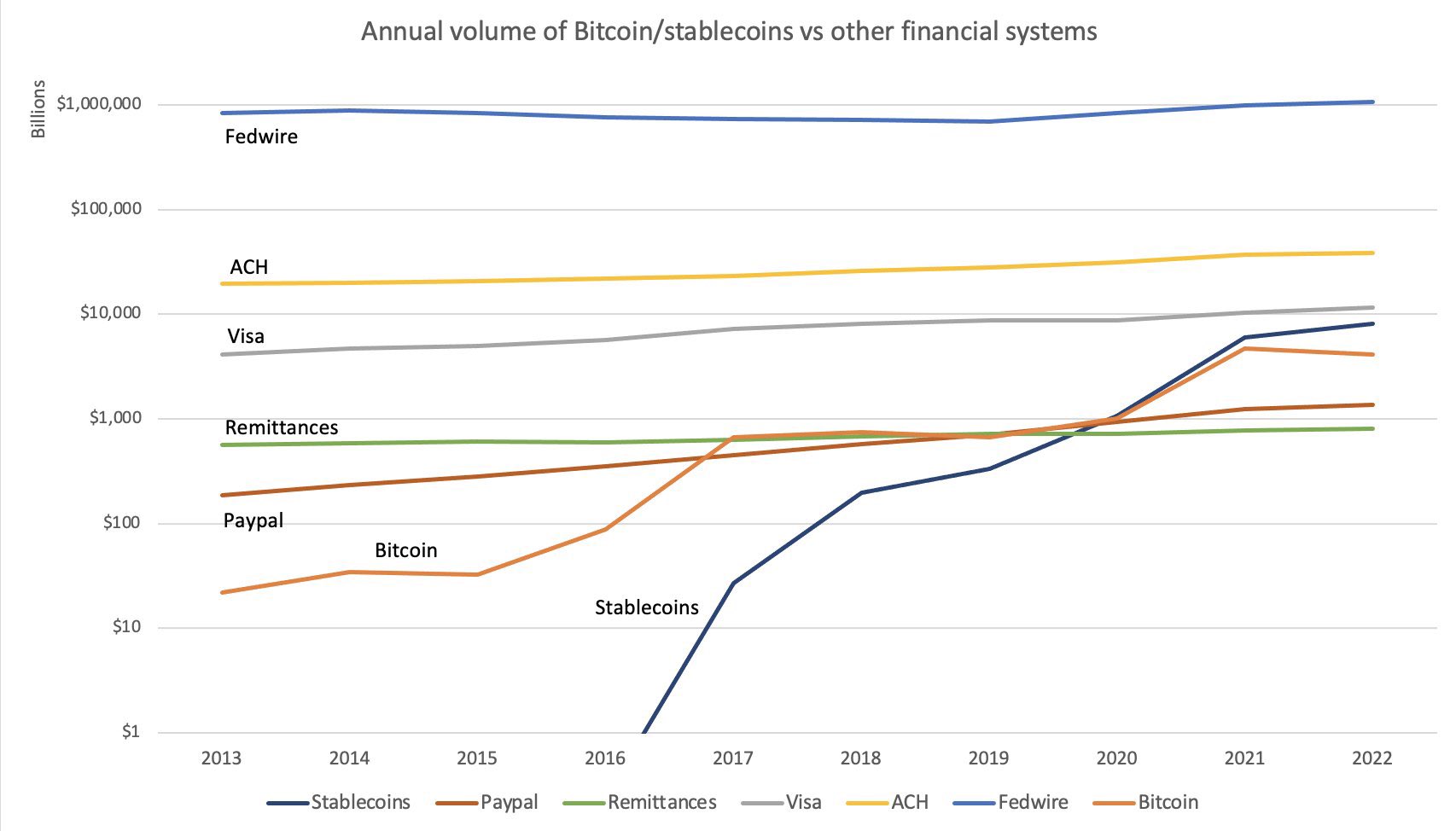

➡️ Money sent on the Bitcoin blockchain this year has surpassed PayPal and is nearing Visa.

➡️ “Bitcoin nodes are now one step closer to being able to sync in seconds. This is game-changing. Light clients can now sync instantly, and full nodes will soon be able to do so as well! Don’t know what I’m talking about?” Great article by Namcios. He is a features writer and reporter at Bitcoin Magazine covering relevant news and developments in Bitcoin.

Read the article here. https://bitcoinmagazine.com/technical/bitcoin-nodes-now-one-step-closer-to-instant-sync

Traditional Finance & Macro/Geopolitics:

🏦Banks:

👉🏽 “US commercial banks lost $71.2 billion in deposits last week. If this was 2008, that would’ve been the 3rd largest outflow during the entire Great Financial Crisis. Since the March 2023 banking panic… it’s only the 8th largest.” Joe Consorti

When banks lose deposits they can:

1. Increase deposit rates (bad for margins)

2. Leverage assets via repos (collateral worth less so less funding)

3. Sell bonds (realizing losses)

4. Issue shares (time-consuming)

Banks are between a rock and a hard place, and the above sure puts it in perspective. But gladly we have the BFTP. Using that program banks can get unsecured lending from the Fed.

We all know that the US economy runs on debt. Debt comes from banks via loans. Now read the above again and the bit below on the US debt & and deficit.

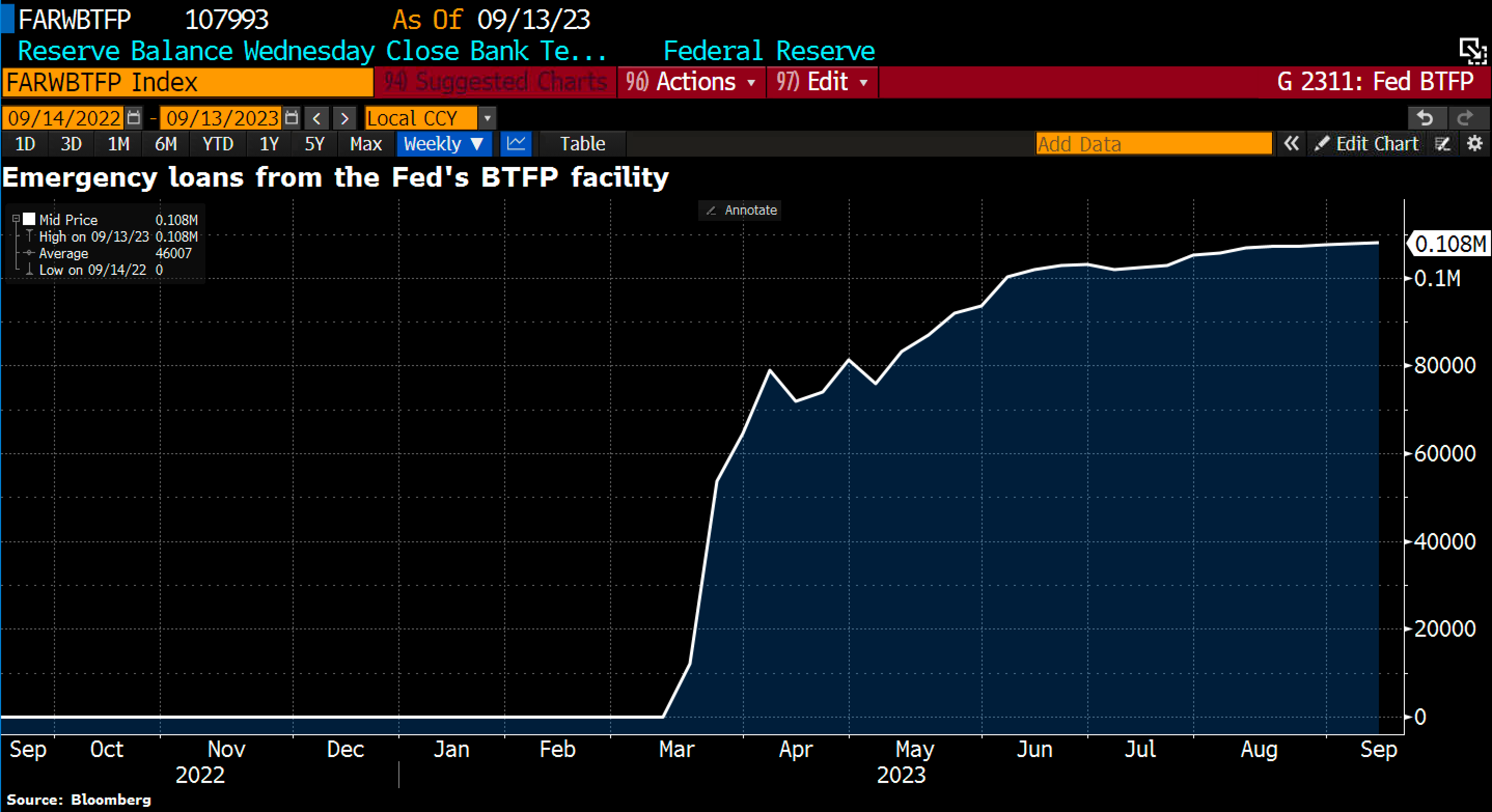

👉🏽A bank liquidity indicator sounds the alarm! Emergency loans from the Fed’s BTFP facility rose to $108bn this week – a new high – as long-term US govt bond yields keep rising. Growth has been flat for 15 weeks, acute regional bank stress hasn’t faded though. Banks are just selling securities instead of going to the Fed — banks’ UST & MBS holdings are down $158 billion since March.

“2023 has been the biggest bank run in a very long time. US banks have lost roughly $633.85 billion in deposits since January.

-Deposit flight

-Credit contraction

-Economic contraction

Not great for the US economy.” – Joe Consorti

🌎Macro/Geopolitics:

👉🏽 In Germany, where long-term interest rates keep rising, this makes debt more and more expensive. 30y Bund yields recently rose to 2.82%, the highest level since 2012.

👉🏽 US childhood poverty more than doubled from 5.2% in 2021 to 12.4% in 2022

👉🏽 August CPI inflation data shows the US inflation rate rose to 3.7%, above expectations of 3.6%. Core CPI inflation fell to 4.3%, in line with expectations of 4.3%.

This week we will see what the Fed will do. Given two months of rising inflation will the Fed raise the rates once more on Wednesday?

👉🏽Last week I mentioned that in the US corporate bankruptcies are rising at the fastest pace since 2010 (barring the pandemic), and are double the level seen this time last year.

On the 13th of September we found out that in Germany, the number of corporate insolvencies is rising sharply. In June 1548 comps went bankrupt, +36% YoY. In H1 2023, German district courts reported 8,571 corporate insolvencies filed. That was 20.5% more than in the 1st half of 2022.

Germany is not alone in its current problems. But Germany’s leadership on specific energy and trade policies – overly lauded until recently – put the whole of Europe in a vulnerable position. This is a structural weakness now. Not easy to fix.

👉🏽 The U.S. is spending 100% of current tax receipts on social programs and entitlement benefits, and then an additional 33% equivalent of tax receipts each on interest expense and the defense budget. – Dylan LeClair

How I see it, boomers are going to die then will leave everyone else holding the bag. 100% of tax receipts are just a total pyramid scheme to fleece the young to pay the old.

In general, the US has a spending problem. “It is now running a deficit that equals 8% of GDP, slightly above 2008 lows. Furthermore, deficit spending as a percentage of GDP is roughly DOUBLE the historical average of 4%. While the Fed is no longer forecasting a recession, deficit spending is at 2008 levels. This is another major reason why interest rates continue to rise. Deficit spending is so large that over $1.9 trillion of US Treasury bonds are being issued over 2 quarters.”

👉🏽 In Canada, all of a sudden price controls are on the table. You can’t make this shit up. Trudeau says the heads of large grocery stores need to come up with a plan to stabilize food prices: “Let me be very clear: If their plan doesn’t provide real relief … then we will take further action and we are not ruling anything out, including tax measures.”

Socialists have zero understanding of how the economy works. ZERO! Price controls won’t work, never has been.

Want to learn more on this topic and why I say this: read the book ‘Forty Centuries of Wage and Price Controls: How Not to Fight Inflation: https://amzn.to/3r71ak4

May I remind you that Canada is a G7 nation.

👉🏽 The US government posted an unexpected $89 billion surplus to their budget in August. Why did this happen? Due to a $319 BILLION reversal of the student loan forgiveness plan after the Supreme Court ruled it unconstitutional. Had student loan forgiveness been approved, the US would have posted a $230 billion DEFICIT for August. Still, the US deficit YTD is at $1.5 trillion and up 61% compared to last year.- The Kobeissi Letter

👉🏽 “American workers are now striking at some of the highest levels on record. Last month alone, large stoppages from strikes resulted in 4.1 million missed days of work. This is, by far, the largest volume of work stoppages since August 2000. As the UAW strike kicks off, we are on track for a record of workdays lost to strikes in 2023. People are feeling the pain of inflation and want higher wages.” -The Kobeissi Letter

👉🏽 Remember the below statement from last week’s Weekly Recap: (and I encourage you to read the full statement)

“Germany’s utopian energy fantasies are getting wrecked on the sharp rocks of reality. A solar industry magazine reports that 15% of Germany’s solar panels could be defective.” Here is the article: https://t.co/kyuJx9rmiU

Here is some fun fact / additional data:

In 2009 there were about 35.000 people employed in the nuclear industry in Germany, which at that time produced 135 TWh of electricity.

In 2016 there were 160,000 people employed in the German wind-turbine industry which produced a total of 80 TWh of electricity.

Increased employment, jippieeee!

For more in-depth info on this topic read the following tweet:

🇩🇪German electricity⚡consumers paid €320 billion to help subsidize wind, solar & biomass operators.

Starting in 2000, the "Renewable Energy Sources Act (EEG) surcharge" was included in most consumer electricity bills to finance high feed-in-tariffs (FIT) and "premium"… https://t.co/5Pzz3sbyy7 pic.twitter.com/K8dwW6okcI

— Edgardo Sepulveda (@E_R_Sepulveda) September 12, 2023

TLDR: German electricity consumers paid €320 billion to help subsidize wind, solar, and biomass operators.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The Relai app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy.

For new users, the app can be downloaded from all Play Stores. The iOS version is only available in Swiss, Austrian, German, and Italian App Stores. If you set up a Bitcoin Savings Plan (weekly/monthly) you can use my code CRYPTOFRIDAY and your fees will be reduced by 0.5%!

Check out my tutorial post (Instagram) & video (Youtube) for more info. ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple. ⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it!🧡

Or support my work with Bitcoin:

Disclaimer: This article should not be taken as, and is not intended to provide any investment advice. It is for educational and entertainment purposes only. As of the time of posting, the writer(s) may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency, as all investments contain risk. All opinions expressed in these articles are my own and are in no way a reflection of the views of the used sources.

Latest articles:

The Latest Bitcoin & Macro news: Weekly Recap 30.07.2024

🧠Quote(s) of the week: 'In a world of exponentially growing trust problems, it is prudent to own Bitcoin, the only asset that requires zero trust.' -James Lavish 'Bitcoin is a tool for: Financial inclusion Banking the unbanked Eliminating financial discrimination...

The Latest Bitcoin & Macro news: Weekly Recap 22.07.2024

🧠Quote(s) of the week: 'The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.' -Nassim Taleb 🧡Bitcoin news🧡 Now before I start with the Weekly Recap I want to...

The Latest Bitcoin & Macro news: Weekly Recap 15.07.2024

🧠Quote(s) of the week:'If you want to keep the smoke and mirrors, endless war machine charade going... buy US Treasuries and other government bonds. If you want to help defund the clown world... buy Bitcoin. Few understand that it's really this simple.' - Dr. Jeff...