Weekly Recap - 18.12.2023

🧠Quote(s) of the week:

“A control structure disguised as a free market will do everything in its power to retain control. and… it gets stronger, by the division of you within it. All you have to do is stop playing by its rules. Bitcoin”- Jeff Booth

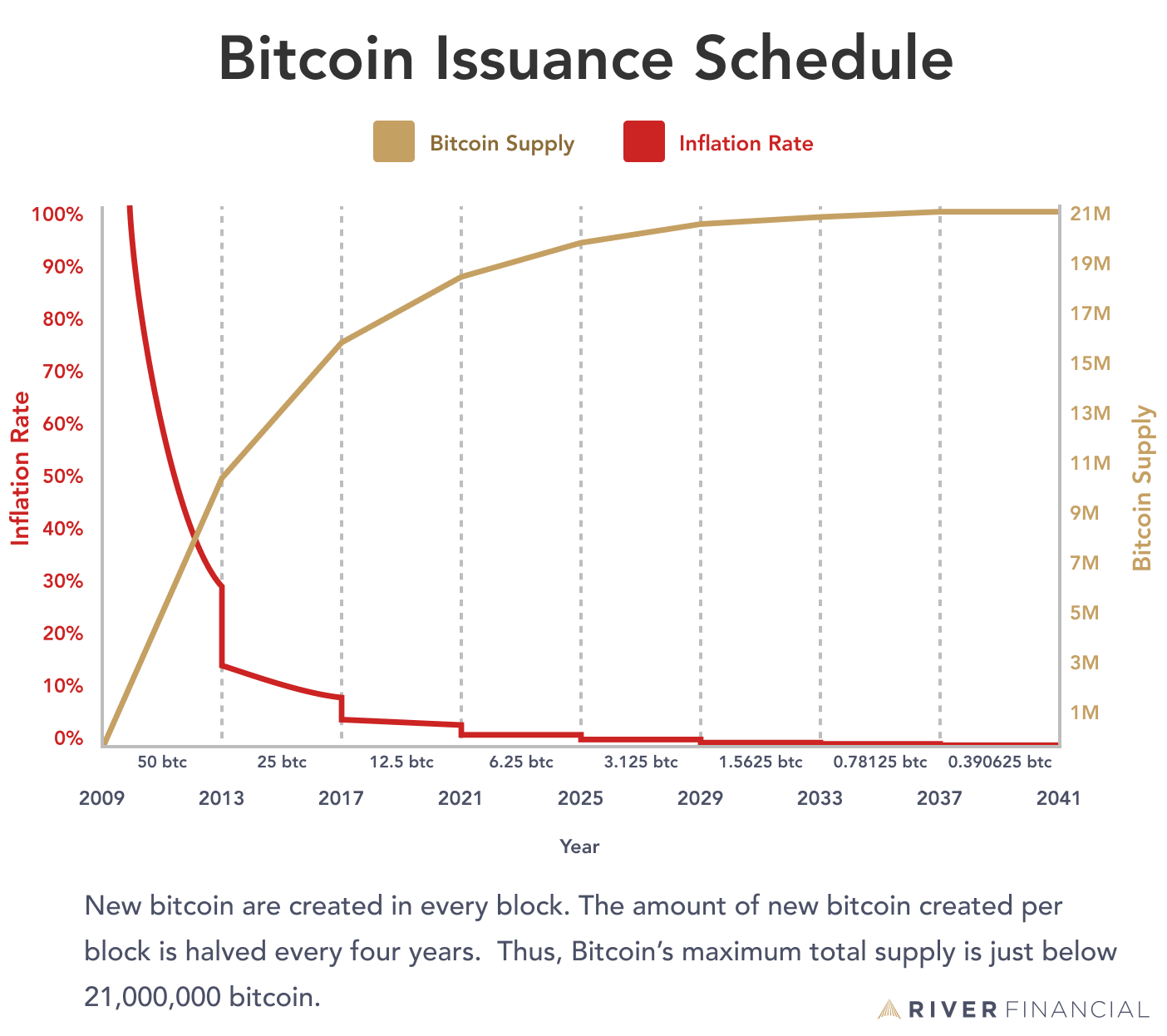

As I said so often. Bitcoin is financial inclusion and financial empowerment. Our current system consolidates power, evident in the 1% owning 43% of global wealth. Bitcoin is promoting inclusivity with its 2.7 billion unbanked potential users worldwide.

🧡Bitcoin news:

➡️ FASB has officially adopted Fair Value Accounting for Bitcoin for fiscal years beginning after Dec 15, 2024. This upgrade to accounting standards will facilitate the adoption of $BTC as a treasury reserve asset by corporations worldwide.

Now why is this huge? Previously companies could only value their bitcoin at the lowest price since they bought it, which meant they would have to record losses, but not the gains when the price recovered. This is an amazing step in the adoption process. This move by FASB is a landmark decision in the accounting treatment of Bitcoin. The tide is turning for Bitcoin. Slowly, then suddenly.

https://www.fasb.org/page/getarticle?uid=fasb_Media_Advisory_12-13-23

For those who want more context and a super simple explanation, here’s a thread all about it from last year:

https://twitter.com/jameslavish/status/1592228100934438913

Or ELID (Explain like I’m degenerate)

“If you YOLO’d your company’s bag into Bitcoin, your balance sheet would only reflect the price at its most REKT. Thanks to the new rules, if Bitcoin pumps you can reflect the ACTUAL price (fair value), and show your shareholder what a Chad you are.” – @DAzaraf

Michael @saylor said this one year ago:

These 3 catalysts will take Bitcoin to $5 million:

1. Spot ETF approval

2. Traditional bank custody of Bitcoin

3. Fair value accounting rules from FASB

It seems like we are getting the first two fairly soon and the third one in 2025. Please forget the price (5 million), it’s about how the network is growing and how the network getting more and more mature. Bullish!

➡️ In the face of a bear market, Bitcoin’s transaction volume share tells a story of unwavering adoption across the globe. Western economies don’t dictate its fate. As economic challenges mount worldwide, Bitcoin shines as a beacon, driving its adoption ever upward. If the West stops Bitcoin nothing changes for Westerners. It’s different in the Global South. Bitcoin can not be stopped there. The people won’t allow anything to stop it. And it’s only getting stronger.” – Sooly

Bitcoin is the only asset that anyone in the world can hold.

➡️ “BlackRock has amended its Bitcoin ETF structure to make it easier for Wall Street banks like Goldman and JP Morgan to own Bitcoin — even though regulations prevent banks from holding Bitcoin directly. This model is designed to improve investor protection and reduce transaction costs, both key SEC requirements for approval.” – Bitcoin Archive

➡️ The narrative amongst the institutional and leftward-leaning is changing: the ESG criticisms are moot, and Bitcoin is a force for good.

Last week the Financial Times published its first cautiously pro-Bitcoin ESG article.

If they are writing pro-bitcoin ESG material it’s because the decision makers on high have finally allowed it.

Funny isn’t it how the narrative has shifted a complete 180? Ow well, let’s have a look at a ‘decision maker’:

https://twitter.com/PrestonPysh/status/1734992631535386766

➡️ Last week Bitcoin price closed UP 8 weeks in a row for the first time since 2017.

Last week I wrote the following:

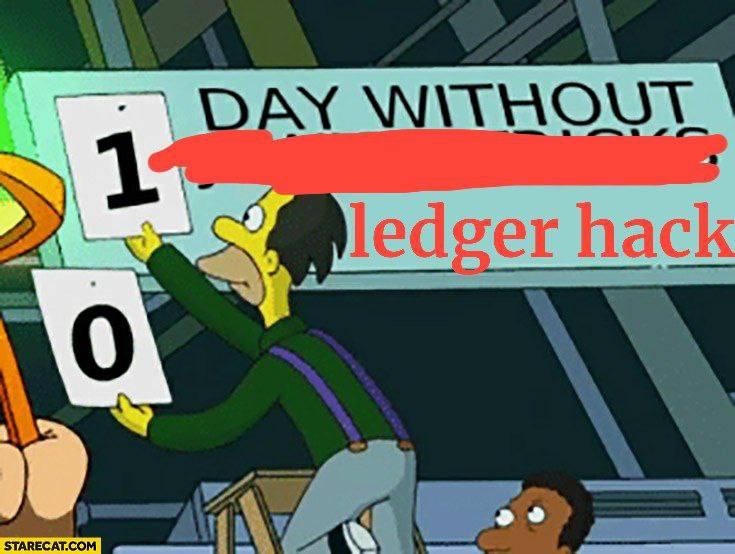

“If you have a Ledger you might want to consider another hardware wallet, you should at least stop using Ledger Live and switch to Sparrow Wallet.

When it comes to privacy and potential downsides of Ledger in the future, I would not recommend Ledger anymore.

In summary / Red flags for Ledger:

User data leaked (3rd party – supplier got hacked). Now people are being scammed or harassed by phone. It’s not entirely Ledger’s fault, but still very unpleasant.

Marketing/gear: Caps and chains to hang or store your ledger in. In my opinion, it makes no sense for a company, especially a hardware company, to sell such merchandise. It goes against the ethos of Bitcoin/Cypherpunks regarding privacy.

Closed source – in short, preferably you want a hardware wallet that is open source. Like the hardware wallets mentioned below.

Recovery service is perhaps my biggest concern. Ledger can/does possess your private key. This could, for example, be given away if a government were to intervene. Or if a server at Ledger were to be hacked, your private key could (theoretically) be stolen.”

This week we learned the following.

“Ledger Connect Kit Breach: Hacker Siphons $484K, Company Rolls Out Version 1.1.8

The unknown attacker that compromised Ledger’s Connect Kit Library has reportedly siphoned $484,000 from wallets, according to the on-chain intelligence firm Lookonchain. Ledger disclosed a former employee fell victim to a phishing attack and the attacker gained access to the Ledger Connectkit Library and uploaded a malicious bug.” -BitcoinNews

If you want to learn more on this matter: https://twitter.com/MatthewLilley/status/1735285684070461534

Ledger has learned nothing about opsec from multiple breaches. At this point, I don’t think anyone should in good conscience recommend their hardware or use their libraries. What happened?

I bet 80% of Ddefi and blockchain projects have the same level of opsec or worse than Ledger. They have yet to be attacked.

That’s why I get mad that so-called influencers are promoting Ethereum and calling DApps a great feature.

Picture (story)

These affiliate-larping individuals are in my opinion more harmful to the space than hacks.

I will quote @NVK 🌞⚡️ (CEO Coldcard):

“It’s not just Ledger; any client software that maintains 1,000s of coins will have the same problem. It’s just too much bloat to maintain and secure. Put your precious bitcoin on COLDCARD and your altcoins stay on the exchanges, where you doing the speculation anyways.”

So what about Trezor? “IMO That’s just virtue signaling, the codebase still has all the shitcoins to be reviewed and share resources, and the desktop client has all the shitcoins in it.”

Which hardware then?

Blockstream Jade for affordability, Bitbox02 (Bitcoin only or the multi-edition if you have shitcoins…but check the above statement), Foundation Passport for user-friendliness, and Seedsigner for trustlessness. You might want to drop the Coldcard in the mix, but one trade of… closed sourced.

Order your Jade here

Order your BitBox 02 Bitcoin Only here

But when it comes to privacy and potential downsides of Ledger in the future, I would not recommend Ledger.

➡️ US Senator Elizabeth Warren introduces bill to crack down on crypto and Warren adds 5 new Senators as co-sponsors to The Digital Asset Anti-Money Laundering Act of 2023.

A reminder that Elizabeth Warren is one of the worst legislators of all time Lifetime stats for Warren Bills:

– 305 introduced, 0 became law

– 1766 Co-sponsored, 45 became law

Warren sponsored:

36 bills in the 118th Congress (2023-24). 0 passed.

103 bills in the 117th Congress (2021-22). 0 passed.

98 bills in the 116th Congress (2019-20). 0 passed.

80 bills in the 115th Congress (2017-18). 0 passed.

27 bills in the 114th Congress. (2015-16). 0 passed.

She’s just a loud-mouthed engagement-bait troll.

Thank god Elizabeth Warren sucks at her job

Any government that prevents citizens from transacting peer-to-peer without surveillance is illegitimate.

And any politician that advocates for such a world deserves to be ridiculed as the tyrannical clown that they are.

Elizabeth Warren is at the top of the list 🤡… pic.twitter.com/G08aQCVSlL

— Stack Hodler (@stackhodler) December 13, 2023

https://twitter.com/thomas_fahrer/status/1734519981675839940

➡️ “Bitcoin is pseudonymous and permissionless. The protocol does not know the number of users, only the number of addresses. This makes all claims relating to concentrated ownership fundamentally flawed.”- Anil

➡️ Valkyrie CIO Steve McClurg on the spot Bitcoin ETF: “We know for a fact that insurance companies and pension funds are looking at Bitcoin as an investment”

➡️ On the 15th of December Marathon broke their own record and mined 125.8 Bitcoin (worth ~$5.3M) in the last 24 hours.

➡️ Former CEO of Google, Eric Schmidt on Bitcoin:

“Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value”

“As Bitcoin network grows the value of Bitcoin grows. As people move into Bitcoin for payments and receipts they stop using US Dollar, Euros, and Chinese Yuan which in the long-term devalues these currencies” – Andrew Howard

Traditional Finance & Macro/Geopolitics:

💸Traditional Finance / Macro:

👉🏽Week ahead: In the US we have consumer confidence, PCE deflator, and new/existing home sales. In Europe, it’s the Euro Area consumer confidence, German IFO survey, UK CPI, and retail sales. In Asia we have the BOJ meeting, and Japan CPI.

👉🏽 3,200 venture-backed U.S companies have gone out of business in 2023 Collectively they raised $27.2B in venture funding.

👉🏽The stock market is near all-time highs with:

1. Core inflation is still at 4%, double the Fed’s target

2. The Fed beginning to backtrack on its “pivot”

3. Markets expecting 6-8 rate CUTS in 2024 while the Fed expects 3

4. The $VIX is trading at its lowest since 2020

5. US interest expense on track to top $1 trillion in 2024

The stock market seems to be disconnected from the economy and reality. Remember, the financial economy and the real economy are two different beasts.

👉🏽 https://twitter.com/lopp/status/1736397634925949114

What do we learn from this?

1. $1.45B in legal fees

2. Bankruptcy lawyers are the real criminals. the greatest legal scam on record.

3. FFS! Please self custody your Bitcoin, this is the way!

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

👉🏽Last week the Federal Reserve kept the rates unchanged! Significantly lower inflation forecast!

SUMMARY OF FED DECISION (12/13/23):

1. Fed leaves rates unchanged for third straight meeting

2. Fed says the growth of the economy “has slowed” since Q3 2023

3. Most Fed officials see interest rate cuts in 2024

4. Median projection shows 3 rate cuts in 2024

5. Fed sees 4.1% unemployment by the end of 2024

6. The Fed sees US GDP growth at 2.6% in 2023 and 1.4% in 2024.

The market is pricing in double the number of rate cuts in 2024 than the Fed projects.

Here you can find a more in-depth summary of Powell’s speech: https://twitter.com/macro_dose/status/1735049579425370605

The Fed admitted they’re going to cut. They blinked and said the silent part out loud, right?

The first comment after the blackout ended was by NY Fed President Williams. He said the Fed is NOT talking about rate cuts now. This is the exact OPPOSITE of what Powell said on Wednesday. To make it even more funnier. Fed member Bostic sees only 2 rate CUTS in 2024 and expects cuts to begin in the third quarter. This comes just hours after NY Fed President Williams said the Fed “isn’t really discussing rate cuts.”

The Fed messed up.

What is a Fed blackout? It’s a period of time around Fed meetings where Fed members are restricted in speaking about Fed policy. This is designed to limit conflicting messages and market confusion around Fed meetings. The blackout period ended yesterday at midnight. (15th of December)

Please have a look at the following tweets. It will show you how the global base ledger is managed in the 21st century.

https://twitter.com/LynAldenContact/status/1735673431662739593

https://twitter.com/WalkerAmerica/status/1735060271712858187

If you are lazy and not checking the links above, to sum it up:

“The Fed Since November 1st:

1. Nov. 1: Getting inflation to 2% “has a long way to go”

2. Nov. 21: “No indication of rate cuts at last meeting”

3. Dec. 1: Talks about rate cuts are “premature”

4. Dec. 1: “We are prepared to tighten policy further” if needed

5. Dec. 13: Rates have peaked, 3 rate cuts coming in 2024

6. Dec. 15: Fed “isn’t really talking about rate cuts”

I thought the Fed could not embarrass themselves anymore. Yet they keep surprising me.

I hope we will get a global base ledger like this:

👉🏽”The current gap between the “price” and “value” of many things in many minds is at/near the widest in history.

For example, if $AAPL dropped by 50% it would be still worth more than the entire German or French market. That’s just one company out of many vs. former European heavyweight countries. The failed experiment called Euro makes out 57% of DXY.”

https://twitter.com/LukeGromen/status/1735711892213997850

Compared to before the pandemic, real wages in Germany have fallen by 7.2%, in Italy even by 9.1%. In comparison, real wages in the US have grown by 2.8% (over q3-2019/q3-2023). Great job Europe!

👉🏽 President @JMilei of Argentina signed an executive order on his first day in office to cut 21 government departments down to 9. Reducing bureaucracy and government is the model to succeed as a society. Smaller governments are better for growth, liberty, and overall well-being.

His official signature in the inauguration book says: ”VIVA LA LIBERTAD CARAJO” English translation: “Long Live F*cking Freedom”

” Argentina’s President Javier Milei announces currency devaluation by 54% and spending cuts in an effort to revive the economy. The new exchange rate has been adjusted to 800 Argentine Pesos per US dollar. Spending cuts include suspending public works, cutting subsidies on transport and energy sectors, and more. Their economy minister said Argentina has an “addiction” to fiscal deficits.” – TKL

https://twitter.com/samcallah/status/1734717431711404280

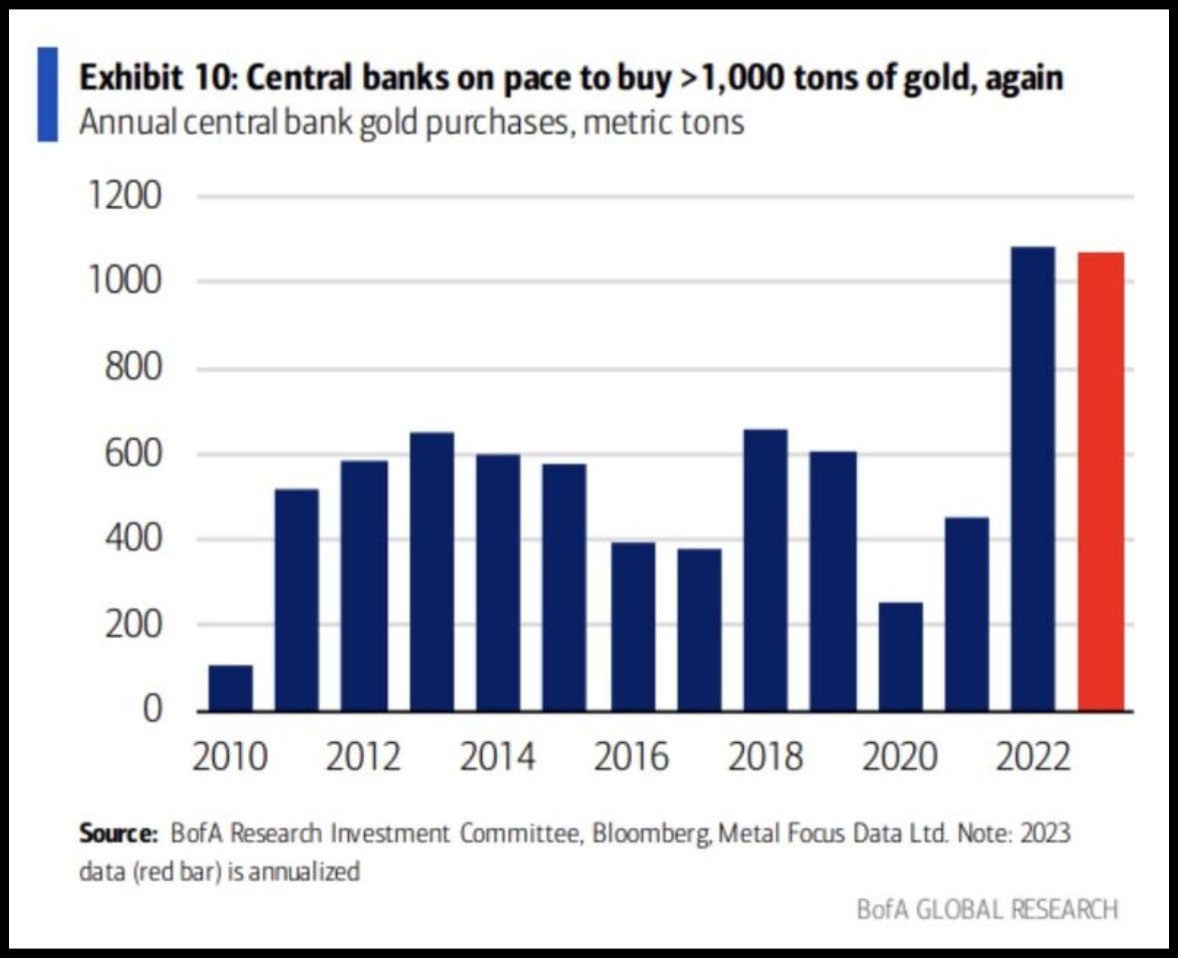

👉🏽”Central banks are on pace to buy over 1,000 tons of gold in 2023. This would be the second-ever year with 1,000+ tons purchased with 2022 being the first. Purchases of gold are 2.5X larger than purchases in 2021 and 4X larger than purchases in 2020. Currently, central banks hold just 20% of their reserves in gold. Historically speaking, central banks hold ~40% of their reserves in gold on average. Are central banks bracing for a massive gold-buying spree?” – TKL

Bitcoin is the best protection from the falling purchasing power of the dollar, (and every other fiat currency), ongoing for 110 years and likely to continue. Central banks seem to be betting on this trend continuing and, perhaps, accelerating.

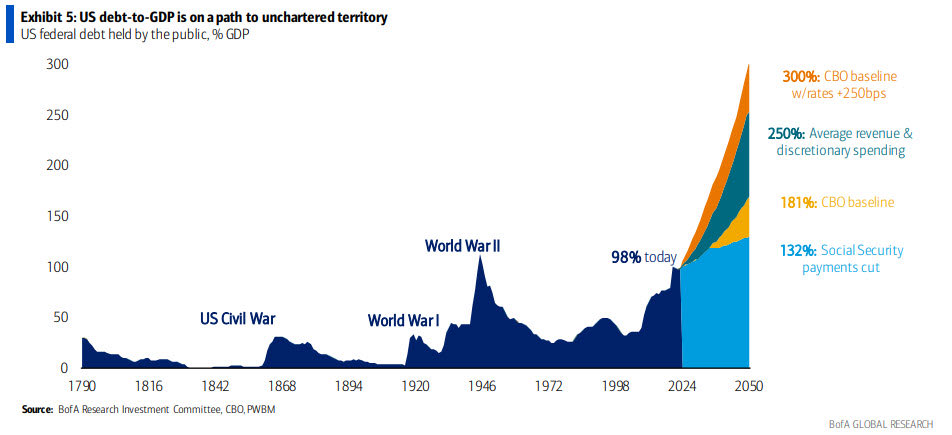

There is no alternative. With US debt-to-GDP at 985 today and on pace to triple by 2050. Not my words, but by the CBO (Congressional Budget Office).

👉🏽 https://twitter.com/WallStreetSilv/status/1736575595645927464

The US added another $2.6 trillion of debt between June 2023 and December 2023. $31.4 trillion to $34 trillion now. The rate of growth in the US national debt is accelerating into a hockey stick chart and nobody in Washington DC is even talking about it.

And some fin-influencers are still trying to downplay this? The money in your bank account is losing its value, FAST!

“While you were sleeping, the US added $12 billion to the national debt. A person making $100k per year and paying zero taxes would have to work for 120,000 years to reach $12 billion. And they can print it with a snap of their fingers.

Opt out: Bitcoin”- Mitchell

🎁If you have made it this far I would like to give you a little gift.

I want to share this episode of Bitcoin Fundamentals where @PrestonPysh and @sebbunney discuss ‘The Hidden Cost of Money,’ exploring money’s deep impact on society, politics, and mental health in a revealing interview.

I just listened to this for the second time.

I can say hands down that this was the best explanation of current economics, the monetary system, and our overall societal situation I have yet heard and the fact that it is presented in a way that is understandable to almost all makes it even more valuable. Seb Bunney is very good at making Bitcoin easy to understand, and how Bitcoin changes everything!

link.chtbl.com

or watch it on YouTube:

https://www.youtube.com/watch?v=JoxqSbwWx-c&embeds_referring_euri=https%3A%2F%2Firis.to%2F

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The Relai app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy.

For new users, the app can be downloaded from all Play Stores. The iOS version is only available in Swiss, Austrian, German, and Italian App Stores. If you set up a Bitcoin Savings Plan (weekly/monthly) you can use my code CRYPTOFRIDAY and your fees will be reduced by 0.5%!

Check out my tutorial post (Instagram) & video (Youtube) for more info. ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple. ⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it!🧡

Or support my work with Bitcoin:

Disclaimer: This article should not be taken as, and is not intended to provide any investment advice. It is for educational and entertainment purposes only. As of the time of posting, the writer(s) may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency, as all investments contain risk. All opinions expressed in these articles are my own and are in no way a reflection of the views of the used sources.

Latest articles:

The Latest Bitcoin & Macro news: Weekly Recap 30.07.2024

🧠Quote(s) of the week: 'In a world of exponentially growing trust problems, it is prudent to own Bitcoin, the only asset that requires zero trust.' -James Lavish 'Bitcoin is a tool for: Financial inclusion Banking the unbanked Eliminating financial discrimination...

The Latest Bitcoin & Macro news: Weekly Recap 22.07.2024

🧠Quote(s) of the week: 'The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.' -Nassim Taleb 🧡Bitcoin news🧡 Now before I start with the Weekly Recap I want to...

The Latest Bitcoin & Macro news: Weekly Recap 15.07.2024

🧠Quote(s) of the week:'If you want to keep the smoke and mirrors, endless war machine charade going... buy US Treasuries and other government bonds. If you want to help defund the clown world... buy Bitcoin. Few understand that it's really this simple.' - Dr. Jeff...