Weekly Recap - 01.01.2024

🧠Quote(s) of the week:

“2024 will be the year your family members tell you you’re lucky for buying Bitcoin early.

They didn’t read the white paper.

They didn’t HODL from $69K —> $15K.

They didn’t listen to hours of podcasts.

They didn’t question the money.

They didn’t do the Proof of Work.” – The Bitcoin Therapist

“Why Bitcoin is the clear choice:

– PoW

– No CEO

– Network effect

– Truly decentralized

– Never been hacked

– Proven by the Lindy Effect

– Global scalability with Lightning

– First absolute scarce asset ever (21M)” – Bitcoin for Freedom

🧡Bitcoin news🧡

Before I start this Weekly Recap – New Year edition special I want to wish you a happy new year fam. May 2024 be the best year for Bitcoin yet and starting to heal this crazy world.

For me, 2023 was a rollercoaster. I am writing this Weekly Recap from my new apartment as on the last day of the year I moved out of a place, once called home. After 7 years of relationship and one beautiful son, my ex and I decided to break up.

2024 will be different in many ways. For me, it will be back to basic and start all over.

My 2024 New Year’s Resolutions:

1. Head down.

2. Work hard.

3. Stack sats.

What can you expect from me in 2024:

More content, more videos, more guides, more orange-pilling, more Bitcoin.

As I said so often. Bitcoin is financial inclusion and financial empowerment. Our current system consolidates power, evident in the 1% owning 43% of global wealth. Bitcoin is promoting inclusivity with its 2.7 billion unbanked potential users worldwide.

Although I am just a pleb, my share in the game called Life & Human History is minuscule…

I do hope that by doing what I do, we all can change the world through Bitcoin education. Let me quote Thomas Fahrer:

“If you own Bitcoin, I work for you. If you don’t own Bitcoin, I work for your kids, their kids, and all future generations. Fixing the money isn’t just an important thing. It’s the most important thing.”

So if you’re reading this Weekly Recap now or in the future, you have a chance to make 2024 (or 2140) one of the best years of your life. You have this chance despite all the obstacles in your way because you have power over your mind — not outside events. And that power makes all the difference. Don’t waste it.

#Bitcoin

Felipe

➡️Now let’s start the Weekly Recap with a 2023 recap by Watcher.Guru:

• US judge rules XRP is not a security.

• $10 trillion asset manager BlackRock officially files for a Spot Bitcoin & Ethereum ETF.

• BlackRock CEO says crypto is digital gold and “Bitcoin is an international asset.”

• Sam Bankman-Fried was found guilty on all charges.

• Elon Musk tells advertisers who are trying to blackmail him to “go fu*k yourself.”

• Russia to use Chinese yuan instead of US dollars to settle trade with Asia, Africa, & Latin America.

• FED Chair Jerome Powell says “Crypto appears to have staying power as an asset class.”

• Changpeng Zhao (CZ) resigns as Binance CEO.

• Coinbase relists Ripple XRP.

• The Chinese Yuan overtakes the US dollar as the most-used currency in China’s cross-border transactions for the first time in history. • Saudi Arabia enters a trade alliance with China, Russia, India, Pakistan, and four Central Asian nations to step further away from reliance on the US dollar.

• Argentina President Javier Milei plans to replace the peso with the US Dollar and shut down the central bank.

• Turkish crypto exchange CEO sentenced to 11,196 years in prison for stealing $2 billion in customer funds.

• SEC drops lawsuit against Ripple XRP executives. • Crypto asset manager Grayscale wins lawsuit against SEC.

• Coinbase sues the SEC, seeking regulatory clarity for the crypto industry.

• El Salvador President officially signs a bill eliminating all taxes on income, property, and capital gains for technology innovations.

• Hong Kong court recognizes cryptocurrencies as property.

• Chinese property giant Evergrande files for bankruptcy.

• Terra founder Do Kwon was arrested in Montenegro.

• US Government arrests SafeMoon founders John Karony, Kyle Nagy & Thomas Smith.

• BlackRock names JPMorgan as an authorized participant for its Spot Bitcoin ETF.

• The UK Government plans to establish new digital asset legislation and make the country a crypto hub.

What do we learn from this?? Things are brewing, stick to Bitcoin, and in the end Bitcoin wins.

Some other interesting Bitcoin data points at the end of 2023:

https://twitter.com/Capital15C/status/1741698499777790054

https://twitter.com/charliebilello/status/1741882201715638559

10-year CAGR: +50% 5-Year CAGR: +63% $BTC returns by year.

Bitcoin in 2023 – closing the year at $42,288 (up ~158%)

➡️ Great investor letter by Stone Ridge Holdings CEO, Ross Stevens.

Bitcoin section in his annual Stone Ridge investor letter is too good:

“Bitcoin is not risky. You cannot print Bitcoin. Fiat is risky. Treasuries are risky. All $33 trillion of them!”

https://info.nydig.com/hubfs/2023-Stone-Ridge-Investor-Letter.pdf

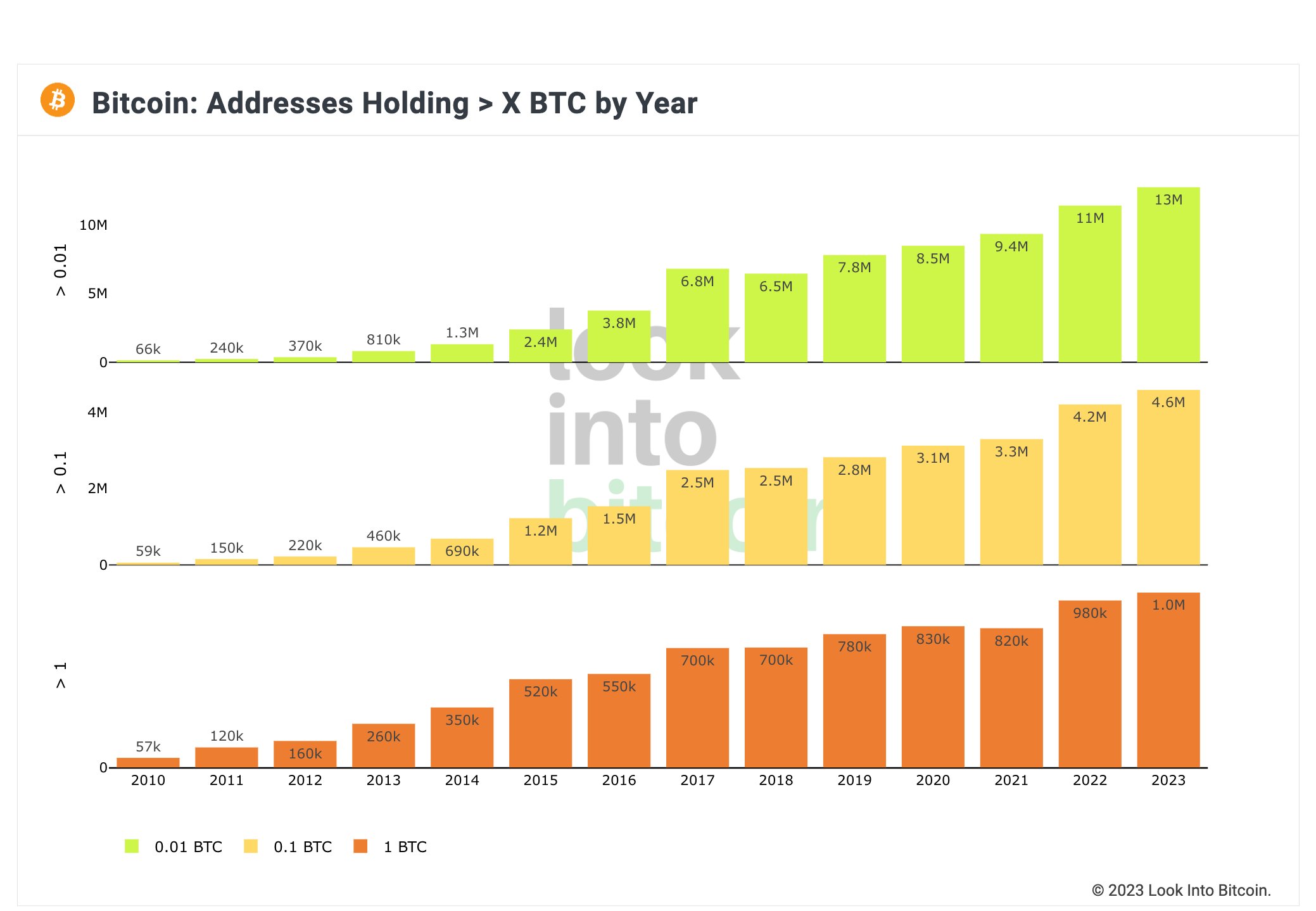

➡️The number of addresses containing at least 0.01, 0.1, and 1 Bitcoin grew significantly in 2023. In particular, the number of addresses with at least 0.01 BTC has undergone the largest increase since 2017.

➡️Coinmetrics estimates (by removing likely change outputs) that $1.4T was transferred via the Bitcoin blockchain in 2023, averaging $45,000 per second.

➡️Bitcoin fees on Friday 29th of December were more than double that of ETH.

ps.: On ETH, Vitalik Buterin proposes a scaling solution for Ethereum which would raise the minimum deposit for validators to 4096 ETH (~$1 million).

Let’s change the rule yet again and more centralization. Classic! It’s called shitcoin for a reason.

Oh on top of that Ethereum and Binance Smart Chain experienced the most DeFi security incidents by far in 2023.

Red flag here, red flag there…if you want to dig a little further, here you go…be my guest:

https://twitter.com/BoringSleuth/status/1740632667765256536

➡️ Bitcoin’s network hashrate increased by 102% during 2023, from 256 to 517 exahash per second.

➡️ Goldman Sachs’ Matthew McDermott on spot Bitcoin ETFs: “One, it broadens and deepens the liquidity in the market… because you’re actually creating institutional products that can be traded by institutions that don’t need to touch the bare assets… and that opens up the universe of the pensions, insurers, etc.”

“Spot Bitcoin ETFs are not a sell-the-new event, but rather a reflection of growing real demand for exposure to Bitcoin. A Bitcoin allocation can significantly enhance portfolio Sharpe ratios,” says Chamber of Digital Commerce CEO Perianne Boring

Anyway please do remember that “ETFs are simply custodial wallets built for suits!” – Matt Odell

Just to make the statement above a bit ‘stronger’…

BlackRock, Fidelity, WisdomTree, and Valkyrie designate Jane Street, SBF’s former employer, as an Authorized Participant for the spot Bitcoin ETF.

hmm built for suits you say…

➡️ Talking about the Bitcoin ETF.

https://twitter.com/AlexOttaBTC/status/1741582290172420274

That is an interesting take on the Bitcoin ETF in comparison with the Gold ETF in 2004/2006. Something I have shared and discussed on multiple platforms since 2021.

Asset managers that submitted timely filings could launch spot Bitcoin ETFs as early as January 10, the SEC’s decision date for Ark/21Shares ETF. SEC could notify issuers by Tuesday or Wednesday for approval, per Reuters

And it is not only in the US. Hong Kong is also set to approve spot Bitcoin ETFs that use either ‘in-kind’ or ‘cash creates’.

➡️ The number of Bitcoin addresses with more than 100 BTC has remained essentially unchanged since 2020. It looks like that Bitcoin Whales HODL.

➡️ Great take by Jameson Lopp on thinking about Bitcoin in terms of thermodynamic security.

https://twitter.com/lopp/status/1741822081145188748

Please click on the link and see how the thermodynamic security is accelerating compared to 2022.

➡️ I will use a Bitcoin miner to heat my home. meme 1

Look at Gridless (miner in Kenya) for example:

https://twitter.com/GridlessCompute/status/1741754315667120302

Use meme 2 in 2024 if you get the question…there is no reason for Bitcoin to exist! Only speculators use it!

➡️The #10 largest Bitcoin holder bought 8,888.88 Bitcoin on the 31st of december 2023 for $379 million.

➡️ On December 27, ARK Next Generation Internet ETF (ARKW) sold:

– 148,885 Coinbase (COIN) shares worth over $27.5 million

– 2.25 million Grayscale Bitcoin Trust (GBTC) shares worth $81 million

– 231,102 Block Inc (SQ) shares worth $18 million.

But Ark invested/bought 4.3 million shares of Prosahres Bitcoin Strategy ETF (BITO).

Interesting, isn’t it?

➡️ The EU contributes just 6% of the global Bitcoin mining hash rate, according to a report by BanklessTimes.

“The EU can improve their hash rate, but for them to benefit, they have to lay ground,” says analyst Alice Leetham

➡️ 41,013 Bitcoin will be mined globally between 2040-2044… Barely over 15 years away. Michael Saylor bought 30,750 BTC in the last 90 days. That’s 38% of all the BTC mined over those 3 months. Yet I still know people sitting in cash waiting for a 20%-60% dip in USD.

Everyone buys Bitcoin at the price they deserve.

https://twitter.com/IIICapital/status/1739708289988829269

➡️ “Nocoiner: Bitcoin hasn’t even hit an ATH yet!

Bitcoiner:

Addresses with >$100 at ATH.

Addresses with >$1k at ATH.

Addresses with >$10k at ATH.

% of Bitcoin Last Active >1 Year ago at ATH.

% of Bitcoin Last Active >3 Years ago at ATH.

Hash rate at ATH.

Difficulty at ATH” – Sam Callahan

I always tell people not to focus on the price, but focus on the growth of the network.

➡️ Tether withdraws 8,888.88 BTC ($379M) from Bitfinex, positioning itself among the top 10 Bitcoin holders. Tether currently holds 66,465.2 BTC with a market capitalization of $2.82.

➡️ https://twitter.com/IIICapital/status/1739690368218673287

“Bitcoin’s Sharpe ratio certainly challenges traditional finance norms, emphasizing its unique risk-return profile. It’s a transformative force in the financial landscape, signaling a shift towards a new global financial system.”

Traditional Finance & Macro/Geopolitics:

💸Traditional Finance / Macro:

Year-ahead Wall Street consensus S&P forecast performance vs reality:

Year Forecast Reality

2021 7% +27%

2022 9% -19%

2023 7% +24%

2024 8% ???

If 2024 has a return of 5% then they were the same on average. Just one thing you need to remember…

Wall Street…governments…the forecasters can not forecast.

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

👉🏽As we finish out 2023, the US Debt now stands at $33.9T, after piling on another $2.5T in a single year. -James Lavish

👉🏽The market is now pricing in a base case of 7 interest rate cuts in 2024. There’s even a 10% chance of 8 rate cuts into 2024 with a ~1% chance of 9 rate cuts. In other words, markets are saying there is a possibility of up to 3 TIMES as many rate cuts as the Fed is guiding. Markets are expecting anywhere from 175 to 225 basis points of rate cuts next year. – TKL

👉🏽China & Saudi Arabia ditch US dollar to sign a 50bn Yuan currency swap for trade. This allows China to start buying oil outside the US-controlled financial system. The world is changing, and the dollar’s reign is crumbling.

🎁If you have made it this far I would like to give you a little gift:

Perfect pod to start the year. WBD755 – 2024, the Year of the Bitcoin Bull with Lyn Alden

In the following interview/podcast ‘What Bitcoin Did – WBD751″ you will learn:

– The macroeconomic landscape of 2023 & 2024

– Inflation, economic growth & central bank policies

– Gold & Bitcoin in a post-fiat currency era

– Bitcoin’s price & legitimacy

“The United States is just set to structurally run these massive fiscal deficits…that’s called fiscal dominance, it’s where the central bank does not have full control…because the amount of public debt & deficits are too big and forcing them to assist it.” — Lyn Alden

2024, the Year of the Bitcoin Bull with Lyn Alden — What Bitcoin Did

Lyn Alden is a macroeconomist and investment strategist. In this interview, we discuss the success of Lyn’s book before delving into the complexities of the cur

www.whatbitcoindid.com

or watch it on YouTube:

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The Relai app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy.

For new users, the app can be downloaded from all Play Stores. The iOS version is only available in Swiss, Austrian, German, and Italian App Stores. If you set up a Bitcoin Savings Plan (weekly/monthly) you can use my code CRYPTOFRIDAY and your fees will be reduced by 0.5%!

Check out my tutorial post (Instagram) & video (Youtube) for more info. ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple. ⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it!🧡

Or support my work with Bitcoin:

Disclaimer: This article should not be taken as, and is not intended to provide any investment advice. It is for educational and entertainment purposes only. As of the time of posting, the writer(s) may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency, as all investments contain risk. All opinions expressed in these articles are my own and are in no way a reflection of the views of the used sources.

Latest articles:

The Latest Bitcoin & Macro news: Weekly Recap 30.07.2024

🧠Quote(s) of the week: 'In a world of exponentially growing trust problems, it is prudent to own Bitcoin, the only asset that requires zero trust.' -James Lavish 'Bitcoin is a tool for: Financial inclusion Banking the unbanked Eliminating financial discrimination...

The Latest Bitcoin & Macro news: Weekly Recap 22.07.2024

🧠Quote(s) of the week: 'The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.' -Nassim Taleb 🧡Bitcoin news🧡 Now before I start with the Weekly Recap I want to...

The Latest Bitcoin & Macro news: Weekly Recap 15.07.2024

🧠Quote(s) of the week:'If you want to keep the smoke and mirrors, endless war machine charade going... buy US Treasuries and other government bonds. If you want to help defund the clown world... buy Bitcoin. Few understand that it's really this simple.' - Dr. Jeff...