Weekly Recap - 29.01.2024

🧠Quote(s) of the week:

“Our revels now are ended.

This our money, as I foretold you,

Was all numbers, and has melted into air, into thin air:

And, like the baseless fabric of this economy,

The cloud-capp’d towers, the gorgeous palaces, the £1m+ ex-council flats, the great s&p itself,

Yea, all which it inherits, shall dissolve

And, as your insubstantial pension fades, leave not a rack behind.

It is such stuff as dreams are made on, and our little wealth

It ended with a crash.” – The ShakespeareanApe

“If you want a market that only goes up (modestly), try stocks.

If you want the potential for outsized returns alongside occasional big drawdowns, try Bitcoin.

If you want to light money on fire, try altcoins.”- Joe Carlasare

🧡Bitcoin news🧡

➡️BlackRock’s Bitcoin holdings now valued over $2.18 billion, and hold 52.025BTC.

➡️Bitcoin whales accumulate 76K Bitcoin ($3B) since the beginning of the year.

➡️Google is the biggest advertising network in the world.

+2x bigger than the second biggest ad network Meta (Facebook/IG).

From today on Bitcoin ETFs can start advertising on Google.

BlackRock & VanEck are now advertising Spot Bitcoin ETFs on Google following a new policy update.

➡️After 11 trading days, the 9 new spot Bitcoin ETFs bought ~140,000 BTC worth USD 6 Billion. This excludes GBTC (conversion w/ outflows).

Grayscale outflows of $5b have been absorbed by other Bitcoin ETFs taking in $5.8b.

$759m Net Bitcoin ETF inflows.

➡️Local news station in Georgia reports a new Bitcoin mine could help lower energy bills and property taxes for the entire city of Sandersville.

➡️The fourth Bitcoin halving is expected to occur on April 20th, 2024, at block height 840,000. The block reward will be halved from 6.15 BTC to 3.125 BTC.

➡️On the 26th of January BlackRock held a webinar to educate financial advisors on their Bitcoin ETF and “what makes this a pivotal moment for investors”.

That wasn’t something I had on my 2024 Bitcoin bingo card.

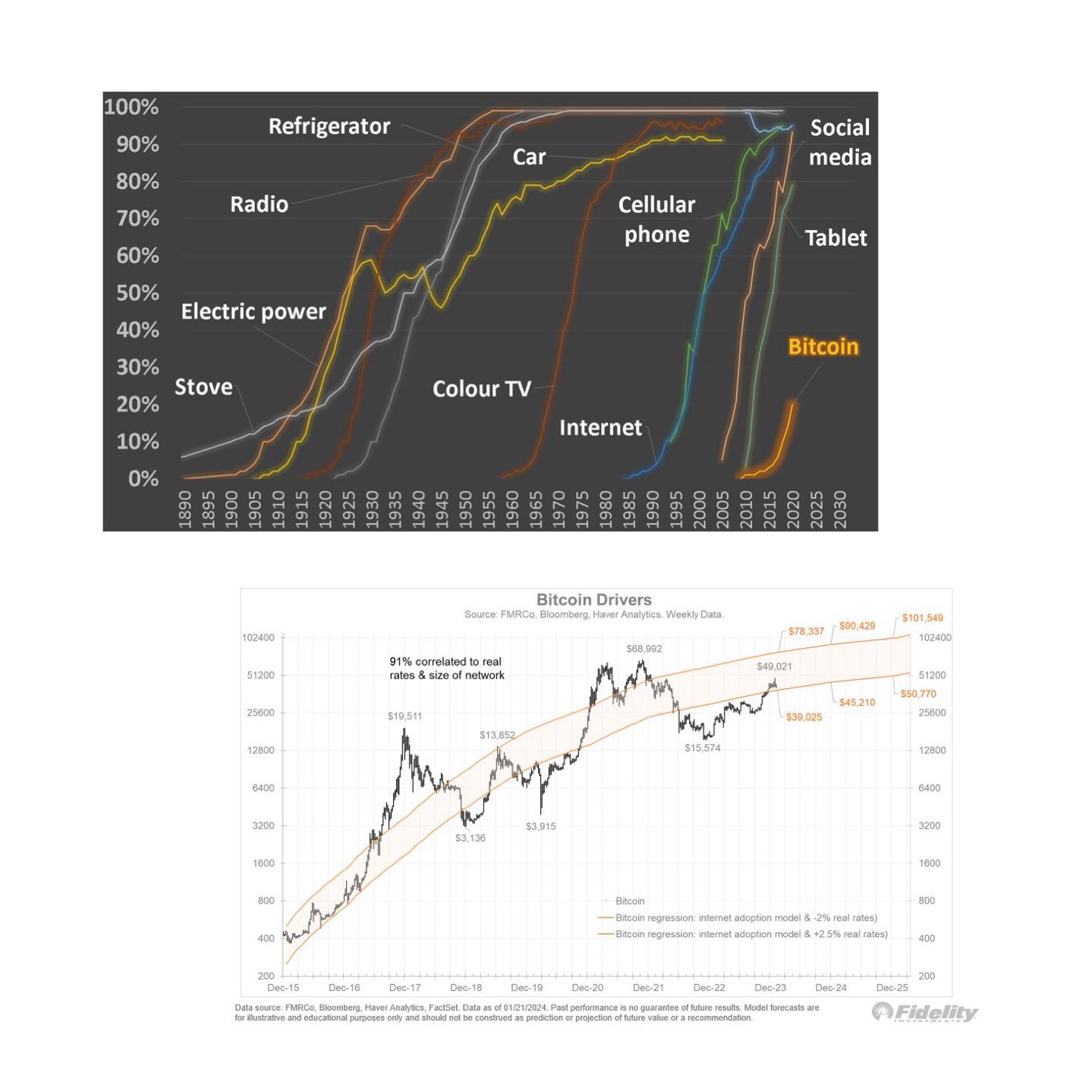

➡️”Bitcoin has the same number of users as the Internet had in 1997.

We are just getting started.”

➡️”The 9 new Bitcoin ETFs have bought 102,613 BTC in just 7 days of trading.

It took MicroStrategy ~300 days to buy +100K Bitcoin.”

➡️On the 24th of January the Bitwise Bitcoin ETF (BITB) became the first U.S. bitcoin ETF to publish the bitcoin addresses of its holdings.

“Now anyone can verify BITB’s holdings and flows directly on the blockchain. Onchain transparency is core to Bitcoin’s ethos.”

Although I think this is a great thing, I do have a couple of questions and remarks.

1. On a positive note, this will be the standard. Try doing this with gold. That’s not possible. There is $11 Trillion in physical gold chasing 250 Trillion dollars in paper gold because the is no transparency to the asset. It is hoarded, controlled, and monitored in secret by 200 governments on the planet.

2. While our current system is based on fraction reserve you now actually have proof of reserve. A real-time balance check of a limited supply asset. This has never been done before in human history. A step closer to a more transparent financial future.

3. This address will be held (custodian) by Coinbase. Not sure if multi-signature is safer in this instance, I don’t have the technical knowledge to provide you with the correct answer. This all depends on the parties & processes involved. What I do know is that not only the Bitwise ETF but almost every ETF can be confiscated by the government.

4. What if people will send sats to that address? Does it get added to the NAV of the ETF holders?

5. Since revealing their Bitcoin address, the Bitwise ETF address has received 10 “donations” totaling 268,002 satoshis (~$107). Numerous tips have been in denominations of 42069 and 6969 sats.

If you want to learn more about the various Bitcoin addresses, here is a great article:

https://unchained.com/blog/bitcoin-address-types-compared/

➡️Also on the 24th: BlackRock & Fidelity now hold more than $3.2b Bitcoin. They’re buying +$400m Bitcoin every day on average.

➡️As you might know or feel the same way as me, Bitcoiners care about truth and proof of work.

Recently a new research from the United Nations University came out.

Bitcoin Policy Institute, in particle Margot Paez, uncovered critical shortcomings in that study as it is fundamentally flawed.

“In short, the study falls short of the scientific thoroughness expected in research, rendering it unsuitable as a basis for policymaking.

Our analysis uncovered three critical flaws in the paper.

1. Selective Bias

The study’s literature review is based on sources that have been discredited and fail to consider newer research showcasing Bitcoin mining’s potential to support grid reliability and advance the shift to renewable energy.

1. Data Misapplication

The authors project past data onto future trends without yearly updates or recognition of discontinued data sources like the CBECI.

1. Flawed Methodologies

Methodologies used are inappropriate for demand-side analysis, leading to unfounded assertions about bitcoin mining’s impact on developing economies and social justice.”

Read the full report here: https://assets-global.website-files.com/627aa615676bdd1d47ec97d4/65b004ac744cd4c6abb8934e_UN%20Paper%20FINAL%20.pdf

This report deserves way more coverage! On the same day, BPI drops a new scholarship from Margot, and Cornell announces their Bitcoin program. “Patterns tell stories and falsehood flies, and the truth comes limping after it!”

➡️https://twitter.com/TimmerFidelity/status/1749825855449121092

The S-curve nature of the Bitcoin network remains on track. “Bitcoin’s network is growing in line with a standard power regression curve”. Jurien Timmer – Dir. of Global Macro Fidelity.

Hello network effects, just zoom out for a bit.

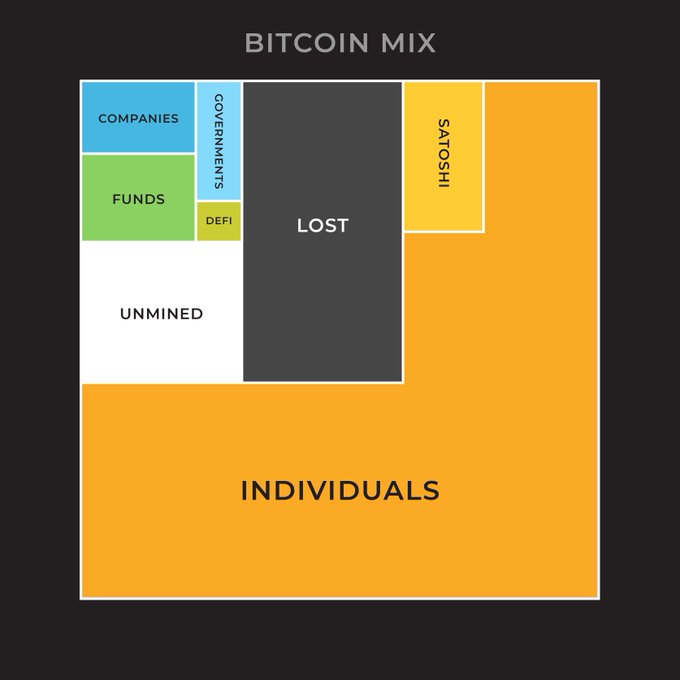

➡️”Twice as much Bitcoin is LOST as is currently controlled by institutions and governments.

Only a tiny fraction of the world owns Bitcoin, and after the halving in April, only 1.3125/21M BTC will be left to be mined.”

This asset will get more and more scarce until every other currency is phased out. With the current world population, only 27% of the planet (max) could have 0.01BTC if it was evenly distributed and all BTC were mined/ available. The Bitcoin ETFs may accelerate the scarcity aspect (once the GBTC selling is exhausted).

It might make sense to get some, just in case it catches on.

Traditional Finance & Macro/Geopolitics:

💸Traditional Finance / Macro:

👉🏽The S&P 500 has officially hit 4,900 for the first time in history.

This puts the index up another 3.5% YTD and 18.5% since October 27th, 2023.

In roughly 3 months, the S&P 500 has doubled the average ANNUAL returnSerious disconnect between the traditional financial markets and the economy. Unfortunately, the price of assets does not necessarily reflect the health of a business.

We were told that the Fed has been tightening the monetary policy. Meanwhile, the monetary base has expanded by $500 BILLION from February 2023.

Two companies, Apple and Microsoft have 6 trillion in combined market cap.

Top 10 companies: $14.6T.

Just 5.5 years ago in 2018, AAPL reached a $1 trillion market cap for the first time.

It has tripled in valuation since then and MSFT more so.

We’re witness to the largest market cap expansion in history. Ask yourself, does a market cap expansion of this magnitude signal that this is a healthy market?

For the stock market and the financial system liquidity matters and is one of the main fuels. Make no mistake this is also valid for Bitcoin. Liquidity matters.

“Owning an SP500 fund is no different from holding a tech ETF.

The top 7 components are all tech companies and represent 26% of its holdings.

SPX should no longer be viewed as a diversification instrument. It’s no longer spreading risk across 500 companies to protect you.”

🏦Banks:

👉🏽 The FED announces that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11. The Fed has raised interest rates on its Bank Term Funding Program, the emergency lending program created to support regional banks.

Rate increases are effective immediately, but the Fed will be ending the program on March 11th.

Rates on new loans will be no lower than the rate on reserve balances. Let’s see which financial institutions will blow up next then!

Do you need an explanation of the above?

https://twitter.com/Invst_Informant/status/1748116617618235527

🌎Macro/Geopolitics:

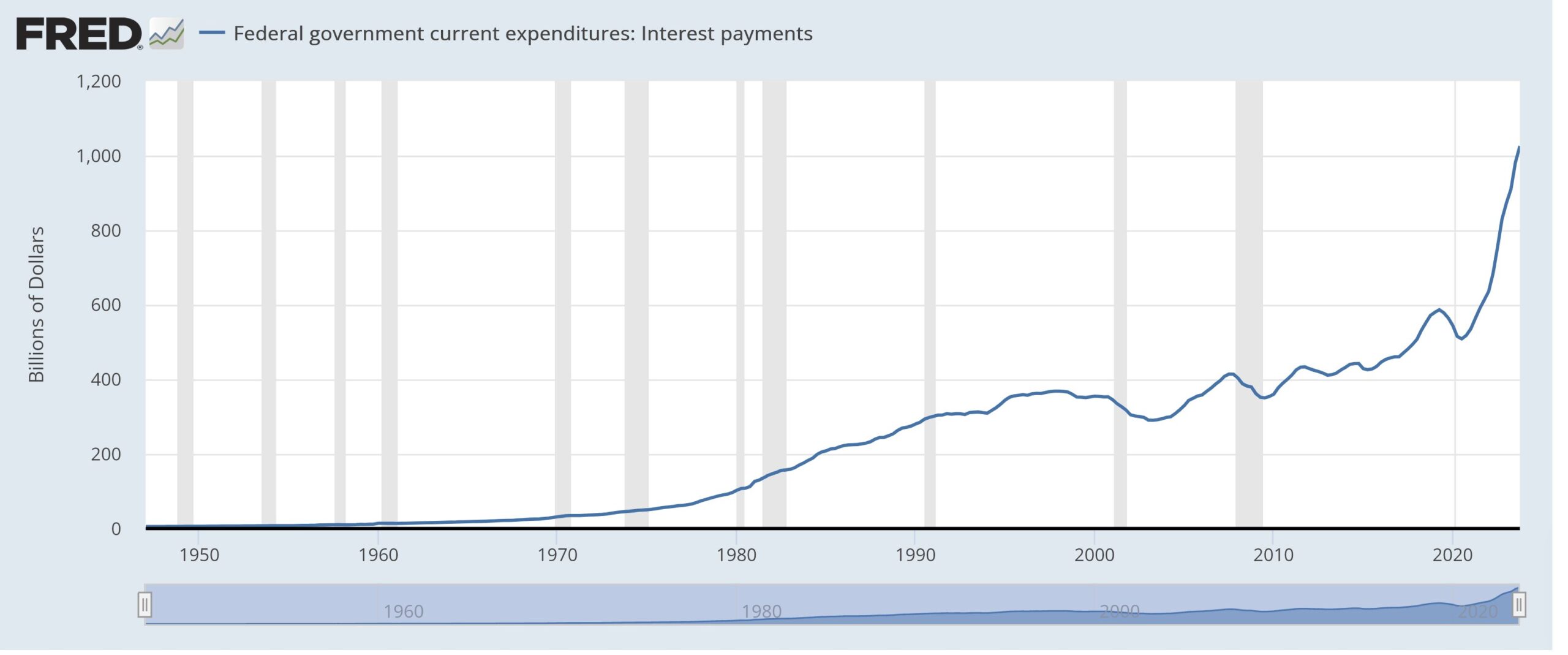

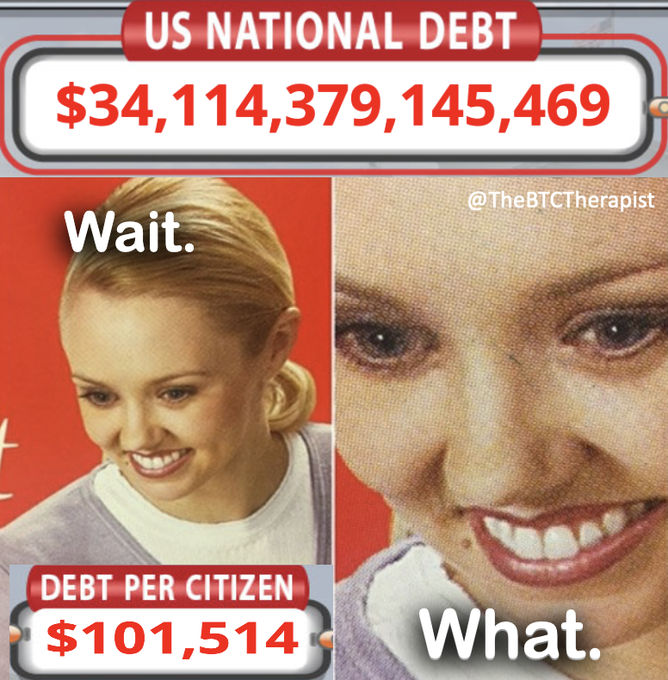

👉🏽 US interest payments just passed 1 Trillion dollars. (foto)

Although some financial influencers did mention that the US economy is strong and thriving based on the Q4 GDP report they are missing or leaving one tiny part out of that same report.

Annualized interest on the federal debt now exceeds $1 trillion and is projected to reach $3 trillion, annualized rate, by Q4 2030 – INSANE and UNSUSTAINABLE.

Even if you adjust for inflation and put everything in real terms (chained 2017 dollars), interest is still going to skyrocket with the current trends

Now on that chart… It assumes steady growth rates for gov’t expenditures, GDP, price indices, etc. – the line is rising rapidly because of the size of the debt and the cost to service it along with the institutionalization of multi-trillion-dollar deficits in the absence of either war or recession…

Ergo: This number goes up because of refinancing debt. Most of this was with <1% rates and is now >5%. That’s a huge increase and the government can’t stop that. Debt rolls over anyway. If no one wants them, the government buys its bonds which causes inflation.

Either 1) rates will go back down to 0% in some fashion which will result in a huge slowdown in growth or deflation, or

2) the government will be forced to cut spending/raise taxes by markets. When was the last time the government cut spending? There is another option, the option that macroeconomist Luke Gromen already mentioned several times last couple of months/ years.

3) We will have a massive inflationary cycle where inflation makes all those numbers trivial. Now for the so-called fin fluencers, I have one question. An increase in real GDP of $1.5 trillion with an increase of public debt of more than $2 trillion is that a strong economy? This so-called “public stimulus” always means more debt, which in turn means more taxes, lower growth, weaker real wages for families, as well as a tougher environment for small businesses. Right?

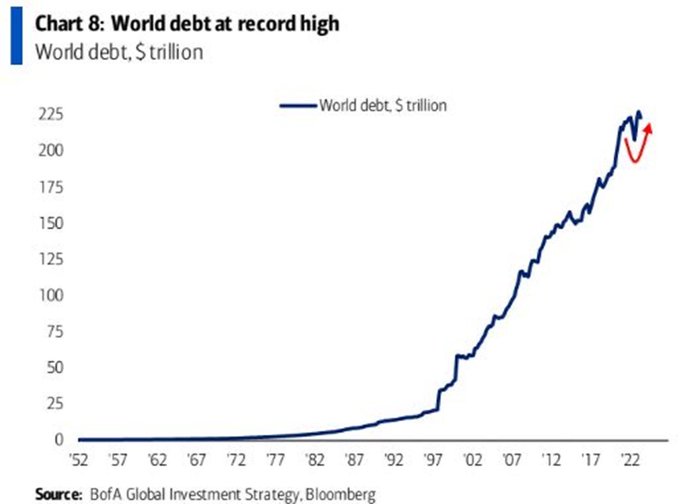

The above is only focused on the US. Below you will find a picture of the world debt.

No read the above segment again and tell me why it isn’t a good thing to hold a % of your portfolio in Bitcoin.

👉🏽More on the debt part:

“For anyone who’s still counting:

The US government borrowed $47 billion of debt yesterday alone.

Since the debt ceiling crisis “ended” in June 2023, total US debt is up ~$3 trillion.

Since October 1st, the US government has borrowed ~$10 billion PER DAY.

The worst part?

For the next 340 days, the US debt ceiling is effectively uncapped.

If we keep borrowing at current rates, we could see over $37 trillion of federal debt this year.” – TKL

No read the above segment again and tell me why it isn’t a good thing to hold a % of your portfolio in Bitcoin.

👉🏽More on the debt part:

“For anyone who’s still counting:

The US government borrowed $47 billion of debt yesterday alone.

Since the debt ceiling crisis “ended” in June 2023, total US debt is up ~$3 trillion.

Since October 1st, the US government has borrowed ~$10 billion PER DAY.

The worst part?

For the next 340 days, the US debt ceiling is effectively uncapped.

If we keep borrowing at current rates, we could see over $37 trillion of federal debt this year.” – TKL

👉🏽Job growth is structurally declining from the post-COVID peaks and is below the 2010-2019 average. Many other smaller components are in recessionary rates of change off their lows. Labor turns slowly with inertia until it is suddenly non-linear.

The following thread, click on the link, is worth your time. Excellent analysis.

“State-level unemployment rates were just released and they continue the string of bad news from the household survey.

It’s been a while since I’ve refreshed this dataset and now my updated state-level Sahm-Rule indicator is really heating back up –

in fact, it’s now above the threshold that marked the onset of every recession since the 1970s.

Through Dec, 20 states (i.e., 39% of the total in the chart below) had triggered the Sahm Rule, up sharply from just 3 states in September.

Nearly 25% of states had triggered the Sahm Rule last Nov when layoffs were picking up in Tech / Real Estate / Finance, but then those tapered off and the share pivoted sharply lower just below reaching the threshold for typical recessions.

More detail on the states that have deteriorated the most over the past year in the following thread” – Parker Ross

https://twitter.com/Econ_Parker/status/1749939545276141757

“Layoffs Announced Over Last 3 Months:

1. Twitch: 35% of workforce

2. Hasbro: 20% of workforce

3. Spotify: 17% of workforce

4. Levi’s: 15% of workforce

5. Zerox: 15% of workforce

6. Qualtrics: 14% of workforce

7. Wayfair: 13% of workforce

8. Duolingo: 10% of workforce

9. Washington Post: 10% of workforce

10. eBay: 9% of workforce

11. Business Insider: 8% of the workforce

12. Charles Schwab: 6% of workforce

13. Blackrock: 3% of workforce

14. Citigroup: 20,000 employees

15. Pixar: 1,300 employees

In 2022 and early 2023, we saw over 300,000 layoffs but they were almost entirely in tech companies.

Now, we are seeing layoffs across all industries as we kick off 2024.”- TKL

👉🏽”China in 2024 So Far:

1. China’s biggest brokerage restricts short-selling

2. China reportedly weighs a $280 billion stimulus package

3. China unexpectedly cuts reserve ratio for banks

4. China tells funds to stop shorting index futures

5. Hong Kong’s stock index hits its lowest level in 2 decades

This all comes after a brutal 2023 for China’s real estate sector.

While central banks have been raising rates, China has been cutting rates.” TKL

Now you know the reason why I mentioned in last week’s Weekly Recap:

“China is contemplating issuing 1 trillion yuan ($139 billion) in new debt through a special sovereign bond plan, marking only the fourth such sale in 26 years

The Middle Kingdom appears to be warming up the money printer.”

On top of that today a Hong Kong court has ruled that Evergrande, China’s largest real estate developer, must be liquidated.

The stock is now down another 20% today on the news and trading has been halted.

Evergrande is now considered the most indebted property developer in the world.

This comes at a time when China’s HY Real Estate Index is down 85% in 2 years.

“China’s holdings of US Treasuries continue to move in a straight line lower.

Their holdings of US Treasuries have declined by $300 billion since 2021.

Currently, China holds just under $800 billion of US Treasuries, levels not seen since 2009.” – TKL

Oops!

👉🏽European Central Bank asks some lenders to monitor social media for early signs of bank runs — Reuters

https://twitter.com/disclosetv/status/1750179011018309974

Hello European lenders!

The ECB tells me you’re reading these posts because you’re having trouble satisfying withdrawal demands.

Is that true, and which European bank is most at risk for that run? Or should we pull our deposits from all of your banks?

“European CBDC is the ultimate test to the European banking system where many banks have nothing to show for assets. Adopting CBDC is like asking banks to convert their cash into gold, but all their cash is long gone and exists only on their fake balance sheets.”

The first rule of bank runs is you don’t talk about bank runs.

👉🏽The Bank of International Settlements is moving forward with the second phase of its CBDC and tokenization initiative.

Among the six programs in the initiative is Project Promissa, which aims to build a proof-of-concept platform for digital tokenized promissory notes

🎁If you have made it this far I would like to give you a little gift:

“Stranded: How Bitcoin is Saving Wasted Energy and Expanding Financial Freedom in Africa” by Alex Gladstein

This is Bitcoin, forget all the numbers go up…forget all the ETF talk, forget the halving…this is why Bitcoin:

For those who cannot see how Bitcoin can (and already is in pockets) transform the African continent’s financial and energy system – this read lays it out beautifully.

https://bitcoinmagazine.com/check-your-financial-privilege/stranded-bitcoin-saving-wasted-energy-in-africa

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The Relai app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy.

For new users, the app can be downloaded from all Play Stores. The iOS version is only available in Swiss, Austrian, German, and Italian App Stores. If you set up a Bitcoin Savings Plan (weekly/monthly) you can use my code CRYPTOFRIDAY and your fees will be reduced by 0.5%!

Check out my tutorial post (Instagram) & video (Youtube) for more info. ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple. ⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it!🧡

Or support my work with Bitcoin:

Disclaimer: This article should not be taken as, and is not intended to provide any investment advice. It is for educational and entertainment purposes only. As of the time of posting, the writer(s) may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency, as all investments contain risk. All opinions expressed in these articles are my own and are in no way a reflection of the views of the used sources.

Latest articles:

The Latest Bitcoin & Macro news: Weekly Recap 30.07.2024

🧠Quote(s) of the week: 'In a world of exponentially growing trust problems, it is prudent to own Bitcoin, the only asset that requires zero trust.' -James Lavish 'Bitcoin is a tool for: Financial inclusion Banking the unbanked Eliminating financial discrimination...

The Latest Bitcoin & Macro news: Weekly Recap 22.07.2024

🧠Quote(s) of the week: 'The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.' -Nassim Taleb 🧡Bitcoin news🧡 Now before I start with the Weekly Recap I want to...

The Latest Bitcoin & Macro news: Weekly Recap 15.07.2024

🧠Quote(s) of the week:'If you want to keep the smoke and mirrors, endless war machine charade going... buy US Treasuries and other government bonds. If you want to help defund the clown world... buy Bitcoin. Few understand that it's really this simple.' - Dr. Jeff...